In June, I wrote that the S&P 500 had become a growth index by Morningstar’s definition (you can refresh your memory here).

I like Morningstar, especially its stock analysis, but it confuses investors by oversimplifying complex topics. While that is a laudable goal (and I try to do the same thing), they go too far.

Well, Morningstar saw the problem that the investment community could see and changed their rules! I want to think that they read my article and made the changes, but I know that’s not the case.

In fairness to Morningstar, they did a very thoughtful writeup, which you can find here, and noted that they last changed their methodology in 2020.

However, I also think investors could be misled into thinking that the S&P 500 hasn’t turned into a big growth index dominated by an unusually small number of expensive stocks.

Ultimately, if I were Morningstar, I wouldn’t have changed anything because the charts we will see below no longer hint at one of the most critical and historically unusual (but not unprecedented) issues facing the market today.

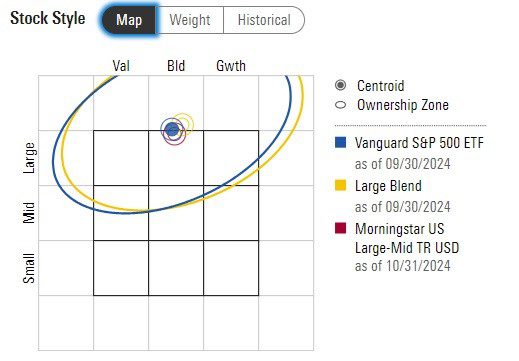

The first chart briefly summarizes an S&P 500 ETF using the Morningstar Style Box. From 2020 to 2022, the dark square in the style box will be in the top row (meaning large cap) and in the center, meaning it will be balanced between growth and value (meaning expensive versus cheap).

Then, in 2023, the dark box moves to the right, signaling a shift to growth or expensive stocks. Then, in 2024, it’s back in the middle, not because the market changed but because the methodology changed. They announced it, but I suspect most people aren’t paying attention (which isn’t their fault, but still).

The next chart shows what the details looked like back in July when I wrote my first article. The following chart shows that everything is centered, but, as I keep saying, nothing in the market changed (it probably got more growth-oriented since July).

I think I may be beating a dead horse here, but the next two charts show a different way to see this issue. Using their old classification system, 39 percent of the S&P 500 was considered large-cap growth, and according to the second chart, that’s now 20 percent. Hm…

We don’t use the Morningstar Style Box for anything that we do. It’s part of our 401k report set, so we’ll need to talk about it. This will make that discussion easier, but not better. For the last few quarters, I had to talk about how Morningstar measures things and why we weren’t switching funds, and now I can just say, ‘Nothing to see here.’

Okay, it’s not that bad, but the younger readers might like seeing a meme now and then, perhaps especially after five dowdy charts. 🙂