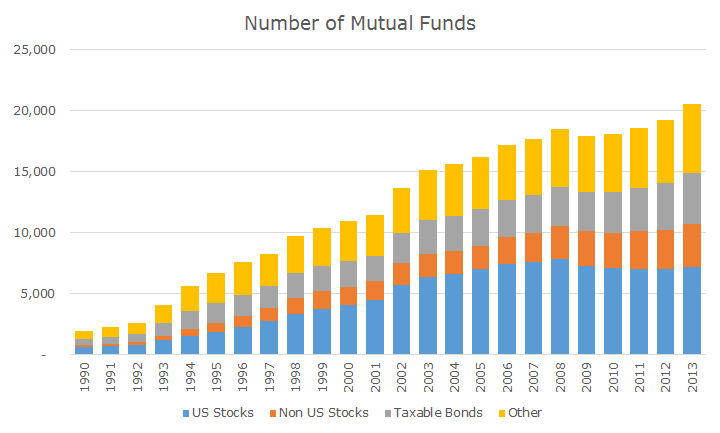

In a recent issue of one of our industry trade ‘rags,’ the following chart really caught my eye:

The chart shows the number of mutual funds by category in the US, according to Morningstar. It’s hard to read, but back in 1990, there were 665 US stock funds, 123 non-US stock funds, 481 taxable bond funds and 686 funds that fall into the ‘other’ category (I am guessing that they are mostly municipal bond funds, but I don’t know for sure).

That’s actually a lot of choices when you think about it: 665 ways to carve up the US stock market, which itself has about 5,000 stocks.

In 1991, there were 4,900 stocks and during the Tech Bubble of the late 1990’s there were as many as 8,000 stocks. The point, though, is that there must have been a lot of duplication in strategy among the 665 mutual funds chasing returns from the same pool of available stocks.

Since 1991, the total number of funds has grown by 10.9 percent per year on average. I’m not talking about the performance of these funds or the number of dollars that they manage, I’m simply referring to the number of funds offered by fund companies that are available to purchase.

By the mid-2000s, the number of mutual funds in US stocks outnumbered the actual number of US stocks in the market. The number of funds did shrink some coming out of the 2008 financial crisis and growth has slowed recently, but that’s partly a function of something that we don’t see in this chart: the explosion of exchange traded funds (ETFs) that investors can buy. I estimate that there are nearly 1,000 ETFs that invest in US stocks today, up from zero in 1991.

Also, keep in mind that this data simply reports the net change in funds each year. If 100 funds were added to the total in any given year, it really means that there were 120 new funds and 20 funds were liquidated or merged away (or some number like that).

I’ve just been talking about US stock mutual funds – but when you look at all of the available funds, it adds up to 20,000 choices – far too many for anyone to really consider! And, really, how could there be 5,000 funds in the ‘other’ category?

Until a few years ago, Acropolis didn’t use any mutual funds, so we didn’t have to worry about finding the needles in the increasingly large haystack. We have used ETFs since we formed as a company, so I can remember the time when we couldn’t get exposure to emerging markets stocks with ETFs.

That’s funny to even consider because, today, we could get three or four different kinds of exposures to emerging markets bonds (not that we want them).

The point is that there are so many choices available, many people have difficulty making good decisions with so many options. When confronted with too many choices, people tend to make worse decisions.

To make good choices, people need defined goals, an overarching philosophy, tools to evaluate the options and a diversity of opinions and perspectives to weigh the pros and cons of all of the possible courses of action.

We continually work hard to make sure that we are in fact doing as well as we can with the choices in front of us, knowing full well that we have incomplete information and that the future is inherently uncertain and constantly changing.

It’s not easy to find the wheat in all of that chaff, but our investment committee continually looks at ways to improve our processes and the decisions that we make on behalf of our clients in an effort to create a better investment experience.