One of the more striking headlines yesterday was that Swiss government bonds now have negative yields out 50 years – that’s right, 50 years!

That’s a little hard to fathom, partly because we don’t have bonds that extend that far, but also because 50 years is such a long time. I mean, if I bought a 50 year bond, I’d be in my 90s before I got my money back.

Forget inflation, I’m just talking about getting my cash back in nominal 2016 dollars. But it’s even worse than that since I would have been lending money to the Swiss for (gulp) 50 years and paying them for the privilege.

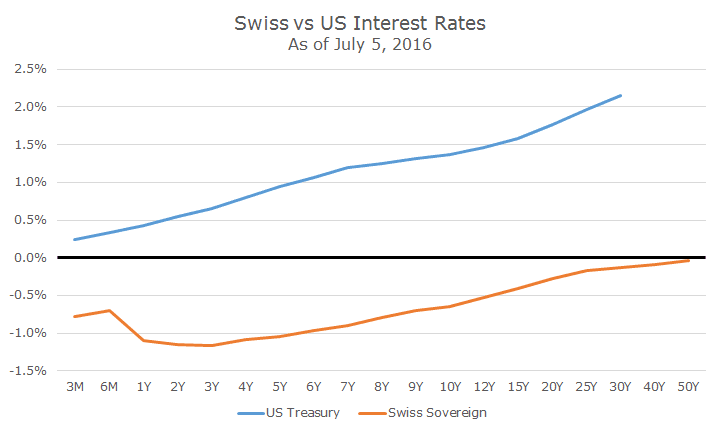

As the chart above shows, their entire curve (in orange) is negative, though some points are worse than others. Our curve (in blue), looks downright fantastic by comparison.

There are two big factors at play here. The first is a flight to quality by European investors who are worried about the impact of the Brexit on the EU. While Britain may come out reasonably well in a few years, their departure reflects a true existential crisis for the union, especially for those countries that share monetary policy and a currency.

Amidst the short-term concerns, is the larger problem, which is that bond investors seem to be saying that they are worried about growth for the next five decades. They’re not especially worried about inflation because they just don’t think there will be much growth to support higher prices.

I too am worried about long-term global growth, but I have to admit that 50 years is further than I can even contemplate. I can’t even say that there’s a 50/50 shot that I’ll be alive in 2066 when the bonds mature, let alone whether or not economic growth with be one, two or four percent.

To me, such a dim outlook is too pessimistic. I’ve been accused of excess optimism, a charge that I accept, but realistically believe that that the answer lies in the middle: slower growth than the last 50 years, but something more than nothing.

We may be stuck with negative rates for some period much longer than we all want, but I just think that 50 years is overdoing it.