Back in the depths of the 2008 crisis, I remember hearing a radio spot for a newly launched series of mutual funds from a well-known fund family that promised ‘absolute returns.’

In the investing world, the term absolute return refers to investment strategies that are intended to generate positive returns regardless of market conditions. Whereas most investments are judged relative to a benchmark like the S&P 500 or Barclays Aggregate bond index, absolute return funds are evaluated based on their returns over cash.

Traditionally, absolute returns funds were confined to the hedge fund industry since the lack of regulation allows hedge fund managers to short stocks (or bonds, commodities and currencies) and use other exotic strategies that are unrelated to traditional stocks and bonds.

Given that stocks were down 50 percent and interest rates were historically low, absolute return funds sounded pretty good. Moreover, this fund family offered four versions with higher and higher expected returns. The first fund was expected to return one percent over the risk free rate over a full market cycle, which they said would be at least three years.

The second fund should earn three percent over the risk free rate, the third five percent over and the last fund was supposed to earn seven percentage points over the risk free rate. Of course, they said that results could vary, but they were confident to name the funds Absolute Return 100 Fund (changing the numbers obviously).

I remember thinking that the return expectations sounded too good to be true. How could someone promise investments that earned annualized rates of return of more than seven percent over the risk free rate? If the risk free rate was around their traditional three percent level, that meant absolute returns of 10 percent or more.

I looked at the funds at the time and I didn’t understand what they were doing, so I pretty much forgot about them until a few days ago when I saw an article in the Wall Street Journal that said that the funds had failed to live up to their bold names.

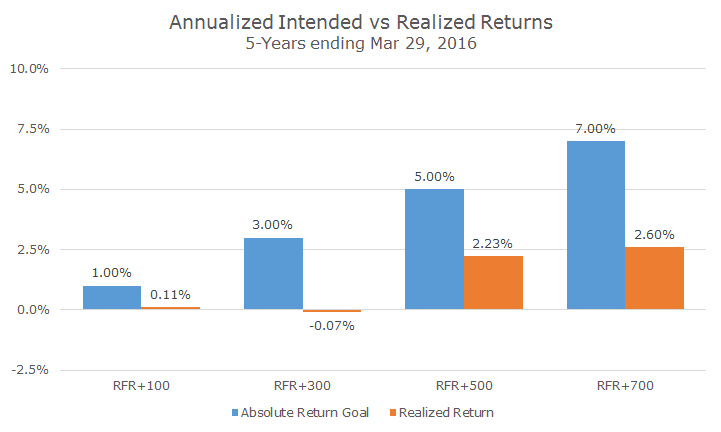

The chart below shows the annualized returns for the funds for the five years ending yesterday and all of them have underperformed their stated goals by 0.9 to 4.4 percent per year.

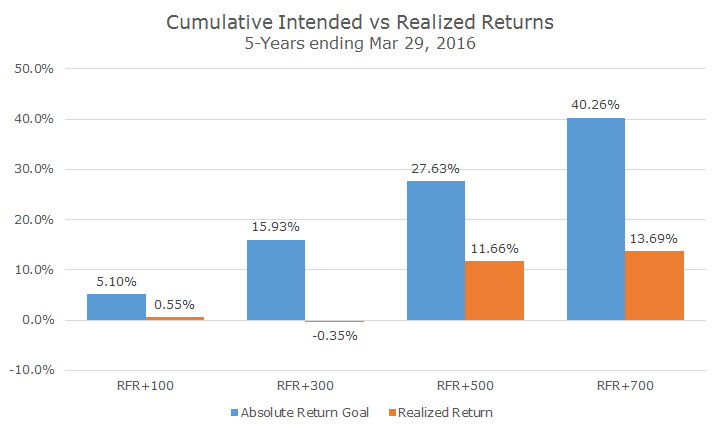

When you look at the cumulative returns over that same period, the results look even more dramatic.

I actually don’t have a particular opinion about whether the funds are good or bad, but the term absolute return is one of my pet peeves – I don’t think anything in the investment business is absolute – especially not returns.

These funds haven’t lost money, so they have lived up to their name in that sense, but the substantial shortfalls are a good reminder about why it’s a good idea to under-promise and over-deliver.