Like most 22-year olds, I didn’t know how to invest my 401k when I started making contributions. I asked some of the people that I worked with and they told me to put 100 percent in the company stock, Mark Twain Bancshares (ticker: MTWN at the time, but long gone!).

Thanks to the magic of my Bloomberg terminal, I can see why they said to buy the stock: in the previous five years (I’m picking May 31, 1995 as my start date, but I don’t actually remember when I started other than that I graduated on a Thursday and started the next Monday), MTWN gained 28.9 percent, versus 11.4 percent for the S&P 500. That works out to a cumulative gain of 255.7 percent compared to a ‘paltry’ 71.5 percent for the benchmark index.

The advice seemed pretty good to me, especially since it earned 37.8 percent in the next 23 or so months, while the market was growing by 24.0 percent; it was the 1990s! Sadly, the MTWN party came to an end when they were bought by Mercantile (ticker: MTL at the time, but also long gone!).

By that time, I had learned a little bit more about investing and realized that company stock wasn’t necessarily the right investment, despite my personal investments. So, I bought a diversified mix of funds, but I still got company stock through the match. Mercantile also did well, but I couldn’t find it because there are many more firms that have Mercantile in the name.

After the Enron debacle in 2001, I thought it was well understood that you shouldn’t buy a lot of company stock in your 401k. I’ve seen articles over the years that participants are putting less and less in company stocks, but I haven’t seen any hard numbers.

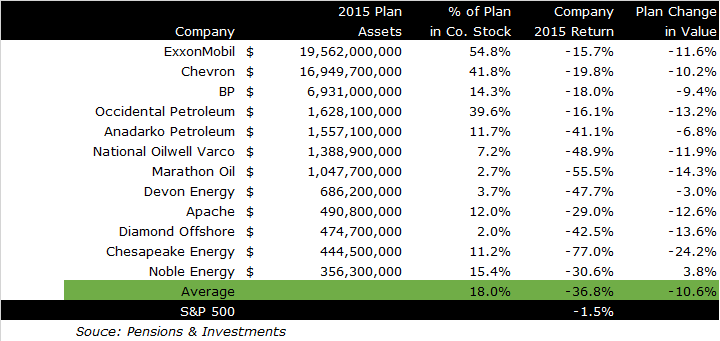

I was pretty surprised yesterday when I read an article in Pensions & Investments profiling the 401k plans for 12 large energy companies. Energy has been a thorn in everyone’s side for the last two years, but the thorn wasn’t large enough to cut your legs off in a properly diversified portfolio.

The largest pension has a shocking allocation in company stock: 54.8 percent as of their most recent filing. That means that it was an even higher percentage at the end of 2014, before the stock declined by -15.7 percent while the stock market only lost -0.7 percent (P&I only calculated price returns for the energy stocks, so I used the price index for the S&P 500).

You can see that the decline in the stock had a terrible impact on the overall plan assets, which declined -11.6 percent. Generally, plans grow in value when the market is flat because participants that are working add more to the plan than retirees who are pulling money out.

Only one plan managed to increase in value (probably due to contributions), three quarters of them lost between -10 and -20 percent and one fell by almost a quarter.

The numbers aren’t perfect here, but the conclusion is straightforward: don’t put all of your eggs in one basket. I didn’t get it when I was 22 years old, but it only took two years to sink in.

It’s too bad that all of those energy company employees didn’t get the message. If you still have a lot of company stock in your 401k, run – don’t walk – to your 401k administrator and make the changes today!