A lot of people are worried about the effect of the Presidential election on the stock market. It seems like no matter who you support, you’re worried that the other candidate will ruin everything.

I have no intention of making any political comments of any kind, and the best way for me to allay any concerns without making half of the folks upset is to take a look at data.

I’ve done this several times over the years, and just reread what I had to say the day before the last election, which you can read here. I wrote: the short answer is that elections don’t matter much, and neither does the party that occupies the White House.

Since it’s only February, this time I’m answering the question that I’ve been asked a lot recently that basically asks whether the whole year is shot because of the election.

And the answer is no.

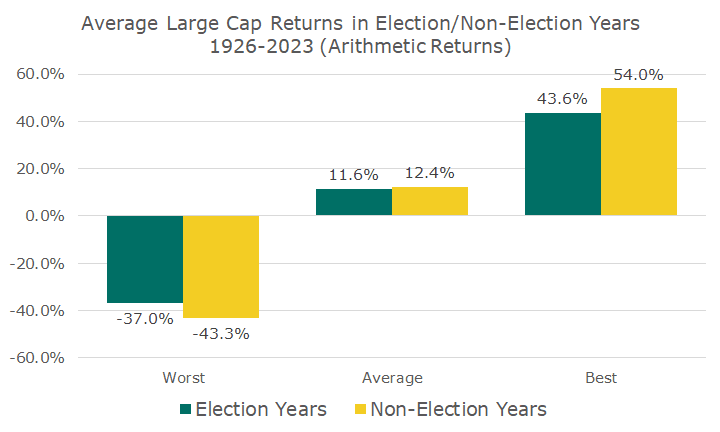

To get to that answer, I took the 98 years of high-quality market data that we have and split each year into two groups: Presidential election years, and non-Presidential election years. We have 24 election years, and 74 non-election years (I’m ignoring Congress).

The simple average of those two groups is almost identical: 11.6 percent for election years, and 12.4 percent for non-election years.

Kudos to you if both of those numbers seem a little high. Whenever we talk about long-term market returns, we talk about a 10 percent annualized return, and so it seems odd that each category in this analysis would be higher than the average.

This is an old math issue, and I’ll do an article on arithmetic versus geometric returns another day – I thought I had one that I could link to this time.

But the real issue is that the two averages are about the same. I see that the non-election year average is higher, but I think this is nothing more than statistical noise because when have three years of non-election year data for every one year of election year data.

When you look at the best and worst returns, they are about the same too – a little better on the downside and not as good on the upside. I think this the same issue – noise.

If we had 50 more years of election years so that the two groups were the same size, I think these numbers would be about the same.

The long and short of it is that election years and non-election years look a lot alike, lending to my view that elections just don’t matter that much to markets.

The policies that come out of whoever wins may matter, but long run market returns are driven by earnings, and companies seem to have a way of making money regardless of who lives at 1600 Pennsylvania Avenue.

On a completely separate note, Acropolis Insights will be on hold next week since I will be on vacation.