We all know that stocks had a tough August with the S&P 500 down -6.03 percent. Things weren’t better in other parts of the world either as the MSCI ACWI ex US index, which is basically the rest of the world outside of the US, fell by -7.59 percent.

Even the bond market, as measured by the Barclays Agg lost money, fell -0.14 percent.

If stocks and bonds lost money, maybe hedge funds made money, right? The word ‘hedge’ is right in their name after all.

So how did hedge funds fare? Well, it depends.

First off, the question is unfair because hedge funds, like mutual funds and ETFs are simply vehicles to pool investments. You wouldn’t ask how mutual funds did today because the answer depends on what kind of mutual fund you’re talking about.

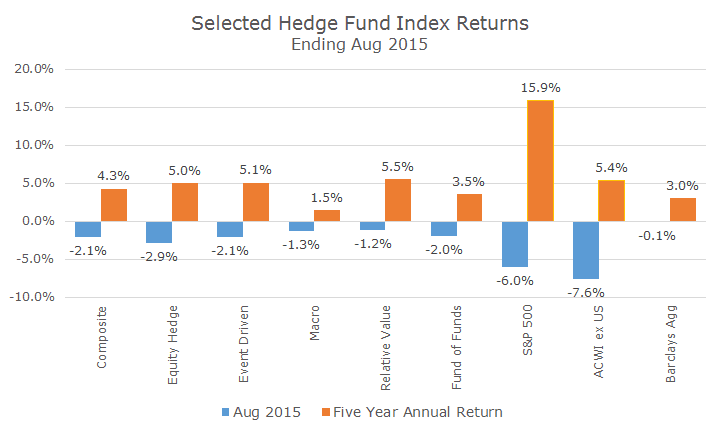

The following chart shows six major hedge fund categories that reflect different strategies for both the month of August (in blue) and for the last five years (in orange).

The data comes from HFRI and although hedge fund data is problematic in general (see more details here), it’s the best anyone’s got, so think of it as close, but take it with a grain of salt (or two).

What you can see is that, on average, hedge funds lost money in August along with stocks and bonds (as seen on the three columns on the far right). Over the last five years, you can see that the hedge funds all have earned low to mid-single digit returns, like non-US stocks and bonds.

What you can also see, however, is that hedge funds generally lost less than stocks last month, which is also consistent with the idea that they didn’t earn as much over the past five years since we believe that risk and return go hand in hand.

This data doesn’t show it, but in general and on average, hedge funds are less volatile than stocks. Most institutional investors pursue hedge funds not for higher returns (although there is obviously some of that), but are instead attracted to the low correlation properties to stocks and bonds that can lower overall portfolio volatility without sacrificing returns.

We don’t use hedge funds and don’t really have a dog in the hunt, but when I hear people talk about how badly they are underperforming the stock market, I feel like it’s not a fair comparison. You could say the same thing about bonds, but of course, you wouldn’t expect bonds to earn as much stocks during good times or lose as much during bad times.

What I do personally find puzzling about institutional interest in hedge funds is that when you run the correlations of these indexes with stocks, they are much higher than you would expect or hope for – especially at a cost that’s typically a two percent management fee and 20 percent of the profits.

Undoubtedly, there are some talented managers out there that earn their keep and these strategies work for investors who understand and are willing to take the risk, but in the aggregate, the cost/benefit ratio of hedge funds is puzzling at best.