Using the words ‘risk’ and ‘volatility’ interchangeably is one of the bad habits of many financial professionals, myself included. When pressed, we know better, but we make this mistake all of the time nonetheless.

Merriam-Webster has four definitions of risk as a noun, two of which are applicable here: ‘the possibility of loss or injury,’ and ‘the chance that an investment (such as a stock or commodity) will lose value.’

Volatility, according to Merriam-Webster, has five definitions as an adjective, although only one is applicable here: ‘subject to rapid or unexpected change.’

When we talk about volatility, however, we’re really only talking about one thing: the standard deviation of the mean. That sounds complicated, but it really isn’t.

The mean is simply the average return, and the standard deviation is the distance from the mean level of variation around those returns. For example, I might say that an investment realized a return of 10 percent, with a realized volatility of 10 percent.

That means, assuming a ‘normal’ distribution, that 68 percent of the time, the investment realized between zero and 20 percent, which is 10 plus and minus 10.

Additionally, if we assume a normal distribution again, the investment returned between -20 and 30 percent each year 95 percent of the time.

And, finally, we can say that 2.5 percent of the time, the investment earned something worse than -20 percent and something better than 30 percent.

Having the volatility information allows us to estimate the kind of risk that we’re taking with an investment, assuming two things: that the future will be like the past, and that returns are normally distributed.

A starting point assumption about the investment might be that in any given year, there is a ~15 percent chance that the investment will lose money. Oh, but then there are the qualifiers: returns aren’t normally distributed and the future may be wildly different from the past.

In other words, we may know exactly what the volatility was, but we don’t know what the risk will be in the future.

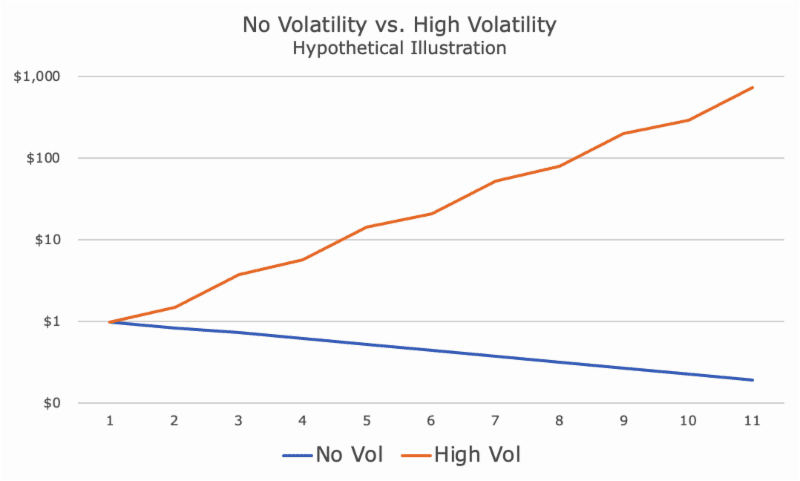

In case this all sounds like nonsense, I thought of an illustration that you might find interesting (and maybe even a little funny?).

Let’s start with two investments. The first investment realized a 10 percent loss each year for 10 years. The realized return is -10 percent, but the volatility is zero! Does the lack of volatility mean that there was no risk? Of course not.

The second investment has a realized return of 93.7 percent return for 10 years and a realized volatility of 52.7 percent. In case you don’t know, the S&P 500 has a realized volatility of about 18 percent when you include the Great Depression and 15 percent when you don’t, so a 52.7 percent volatility is about three times as volatile as the S&P 500.

And, yet, when you look at the returns, you might be pretty tempted to take the high volatility investment since in 10 years, the cumulative return was 74,000 percent. I alternated returns of 50 and 150 percent, but you can hardly tell because I used a logarithmic scale in the chart. You couldn’t even see the losing no volatility investment in a linear chart.

If someone asked me to look at these investments for them, I wouldn’t recommend either one. Obviously, I would need to understand the strategy employed for both of them, but this is a silly example.

It’s pretty obvious why I wouldn’t recommend the one with no volatility – if it continues on this course, it will go from an 80 percent loss to a 99 percent loss in a few years.

The other investment would make me nervous too, and not just because I would assume that it’s a Bernie Madoff type Ponzi-scheme. The volatility of 50 percent would cause me to think that there is a 2.5 percent chance that the investment would get wiped out some year (52.7 * 2 is more than 100 percent!).

There’s an equal chance that the investment will double in any given year, but I wouldn’t want to risk everything for that.

While there is only one definition of volatility for us, there are a million kinds of risk. For fun, I looked at some of the risks outlined in the prospectus for one of the foreign mutual funds that we own:

- Equity Market Risk

- Small Company Risk

- Foreign Securities and Currencies Risk

- Value Investment Risk

- Derivatives Risk

- Securities Lending Risk

- Cyber Security Risk

Each one of these risks has a paragraph or two that describes each risk, but nothing quantifiably.

I think that’s why we as practitioners sloppily use volatility as short-hand for risk. Although we all know that it doesn’t encapsulate all of the risks taken, it’s close enough that we can be lazy. I’ll try and be more careful.