I heard a funny exchange between Gene Fama and Dick Thaler, two University of Chicago professors that sit on opposite sides of the debate about whether markets are efficient. If you’ve got 45 minutes, I recommend watching the whole discussion by clicking here.

As an example of market inefficiency, Thaler told a funny story about a closed-end mutual fund with the ticker symbol: CUBA. The Herzfeld Caribbean Basin fund doesn’t invest in Cuban stocks because as a Communist country, there are no Cuban stocks!

The fund does invest exclusively in the Caribbean region and the largest holdings include a Columbian airline, Royal Caribbean Cruises and MasTec, an engineering and construction firm based in Coral Gables, Florida.

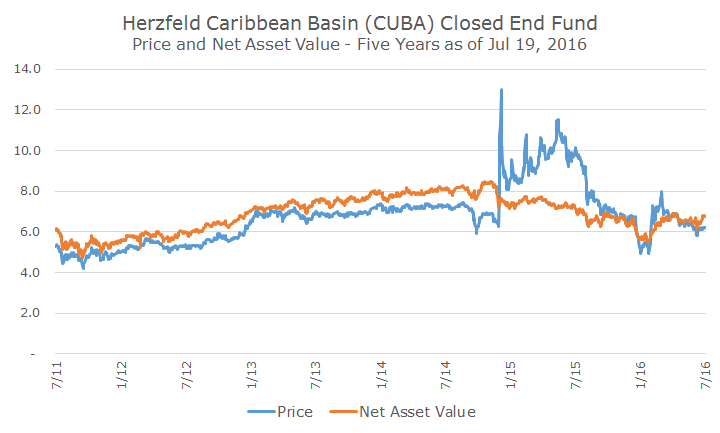

Still, when the Obama and Castro administrations simultaneously announced relations between the two countries in December 2014, the price of the CUBA fund spiked, more than doubling overnight.

Closed end fund (CEFs) like the CUBA fund are an interesting bunch because the market price of the CEF often differs from the value of the stocks in the CEF (for a more detailed explanation, click here).

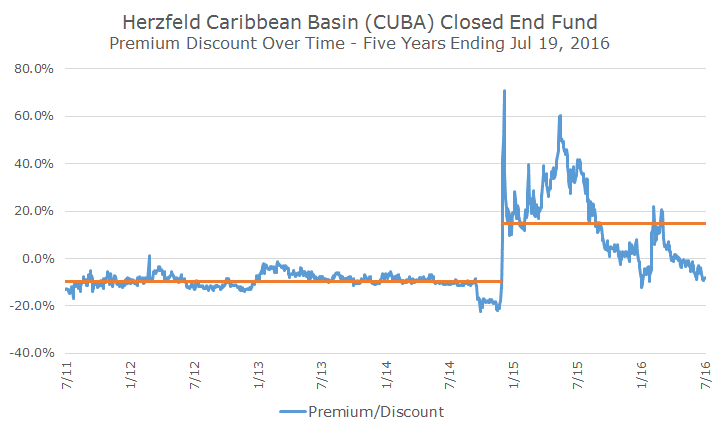

The fact that CEF prices differ much from their known net asset value (NAV) is already a puzzle that the efficient market hypothesis (EMH) hasn’t been able to solve, but the CUBA fund really highlights the inefficiency.

Before the normalization announcement, the price of the CUBA fund traded at a -9.6 percent average discount to the NAV. Why that should happen is a mystery, and unfortunately, these discounts can persist for years (no free arbitrage here!).

After the announcement, well after the initial price spike, the price of the CUBA fund traded at a 14.6 percent premium to the NAV. You can see that the price has fallen below the NAV again, but in an efficient market, if there even was a spike, it should have reversed itself almost instantly.

It’s a great story, but I think Fama has a reasonable response, which is that it’s just an anecdote. There’s a saying at the University of Chicago that anecdotes, even a bunch of them, aren’t as good as data and there are reams and reams of data about how markets are efficient.

In my mind, the story is fun and a good example of how markets aren’t completely efficient. It’s probably becoming clear that I think that markets are largely efficient, but obviously not perfectly so.

We won’t be changing our investment approach, but we will be enjoying good stories like that about the Cuba fund.