Woot Woot! We can surely celebrate that the S&P 500 is back at record levels as of last Friday. I updated a few charts (below), and noticed something interesting – actual investors in the S&P 500 were back in the money in mid-December thanks to dividends.

I am celebrating as much as the next guy about the price improvement, but dividends are part of the equation, but they are often forgotten (including by me in this case).

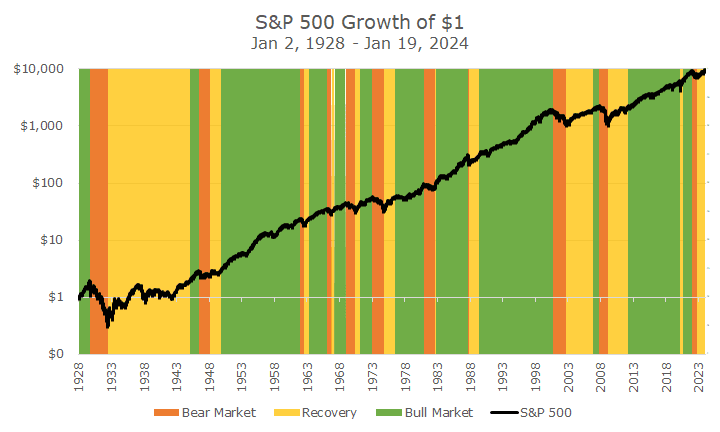

I was updating the following chart when the realization hit me. The chart comes from a unique data set that calculates the daily total return for stocks back to 1926. We created this a few years ago with the help of an intern.

In the 2022 selloff, I created the chart to show the performance of the S&P 500 in drawdowns, recovering from drawdowns, and in growth mode. I think the colors make it obvious. In this case, the image is so large that you can barely see what’s happened in the last month.

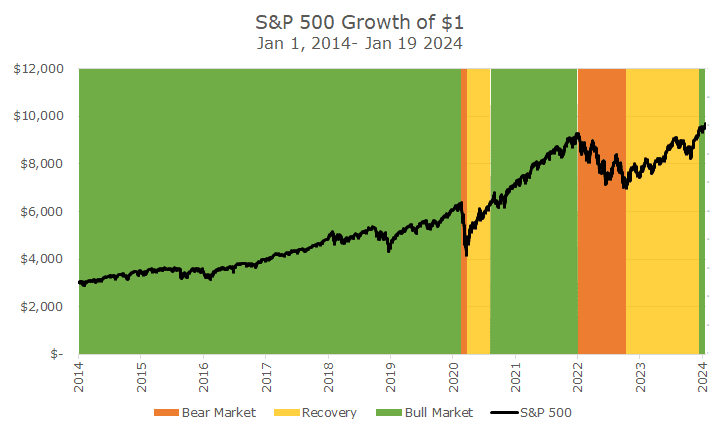

So, I use the same data but only chart back to January of 2014, and now you can see the green bull market that started last December.

I really like the daily total return (price plus dividend) data because, as investors, we get the price movements and the daily return.

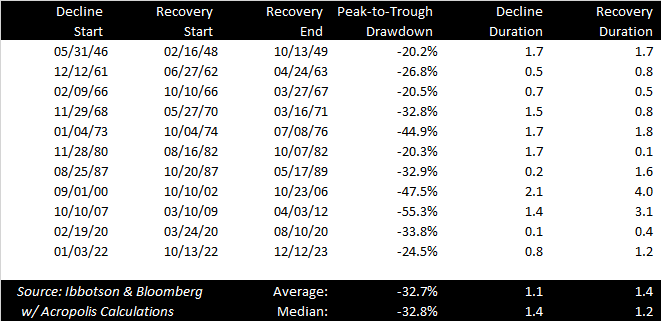

I like the chart with the colors, but I also like table below with our daily data, because it’s a little different than what you see elsewhere. Everyone else uses either monthly total return data or daily price data.

Using the daily price data gets the granularity, but misses an important part of the return, and using the monthly total return has the opposite problem.

We can now say that this bear market was the eighth worst bear market in in history, outside of the Great Depression (which is in its own category). It was the fifth longest in the decline and the sixth longest in its recovery.

(I should have indicated it on the table, but the average and median calculations are for everything outside of the Great Depression).

And, although we don’t see it here, it was pretty lousy because bonds did terribly. I’ll leave more detail for another day since I don’t have daily total return data for bonds, but we all know it wasn’t easy for the balanced portfolio investor.

More than all of those details, what I really like is being able to say, accurately, that there’s never been a bear market that we haven’t recovered from. I couldn’t say that a little more than a month ago because things could have taken a turn for the worst, but it sure is nice to say now.