Just one week ago, I wrote about SPACs as a potential indicator for a frothy market and referred in passing to ‘Robinhood traders’ as another sign of the times. Little did I know that these foes of the rich and friends of the poor would dominate the news and that everyone I encounter would bring up GameStop.

I tried to make the case that the craziness in SPACs probably isn’t a signal of anything really. I hear a lot of comparisons to 1999, and while that may be true, I also think that crazy stuff happens all the time and we simply forget most of it (thank goodness). Who reading today remembers that in 2008, Volkswagen was the largest company in the world for one day, due to a short squeeze in a merger arbitrage? Not many, I’ll bet – email me if you remember that.

The story with GameStop (and the other stocks like it, including AMC Theaters, Koss Corp, Blackberry, etc.) is a little different for two reasons. First, the band of merry traders on Robinhood could be an ongoing force in markets, and second, unlike SPACs, it’s affecting our portfolios.

Although Robinhood is the poster-boy for this kind of wild trading since it’s the brokerage of choice for this type of investor, it’s really the type of investor that could be an ongoing force in markets. And when I say ‘this type of trader,’ I mean anyone that works together, unofficially, with other traders on social media sites to aggregate their ideas and dollars into a massive force.

I like the term ‘social media traders,’ partly because made it up just now, but partly because I think the term ‘retail investors’ is terrible since nearly everyone reading this is a retail investor who doesn’t what Reddit is and has never looked at it.

Investors working together is nothing new. Back in the 1920s, Joe Kennedy famously worked with a cabal of traders to manipulate stock prices on the long and short side. The story goes that he was chosen to be the first Chair of the SEC because he knew how to play the game. Or, how about the Hunt Brothers who tried to corner the market in silver back in the 1970s? Or the countless hedge fund ‘idea dinners’ where power players in New York get together behind closed doors and figure out what stocks to go after.

The difference here is that social media is much more powerful than anything we’ve seen before because anyone can participate. One if the big sites, Wall Street Bets, a Reddit subgroup, has 7.5 million followers (or degenerates, as they call themselves). That’s about as many people that live in the Dallas metropolitan area. Imagine if every single person in Dallas, anonymously, decided to gang up on a handful of stocks. Their usernames and imagery are silly, but they also a lot of market power.

In fact, they are so powerful, that it leads to my second point, which is that their actions are affecting our investments. GameStop, which was a failing videogame retail store in a world that buys videogames online, is now the largest individual stock in both the Russell 2000 and S&P 600 Small-Cap index. Virtually all of our clients have index funds that track one of those two indexes, which means that we own GameStop.

We also have some non-index funds that quantitatively pursue strategies that own GameStop. Our small-cap value fund probably some time ago because the price was cheap. As of November 30, the most recent filing, the fund has $18.5 million worth, which was the 218th largest position, amounting to 0.15 percent of the fund.

If the fund manager did nothing (which I suspect isn’t the case), that position would now be $372 million, the largest position, and 3.1 percent of the fund.

Another fund manager that buys stocks based on their price momentum, had a position in GameStop of $278k, or 0.12 percent of the fund on December 31st. If they did nothing (again, unlikely), the position would now be worth $4.8 million, or 2.1 percent of the fund.

I called our representative from one of the funds on Friday and he didn’t have any updates for me. Some people don’t like that because they want to know what they own, which you can do in an index fund. I don’t mind though, because I’ll bet that the risk management team at each of the fund companies saw what was happening (how could they miss it), and started to reduce the positions.

Seasoned portfolio managers and risk managers know that you don’t want this in your portfolio. They know that it’s almost certainly a temporary phenomenon, and while it was fun in January (GameStop was up 1.600 percent), it probably won’t be fun for much longer.

The index fund can’t make discretionary choices like that – if the index holds it, they have to as well. Most investors judge their funds against indexes, so it may not matter since the GameStop phenomenon will hit both the funds and the indexes.

That doesn’t bother me either, and it gets back to one of the first principles of investing: diversification. While it’s dramatic to say that GameStop is the largest position in our small-cap index funds, we don’t usually allocate a portfolio solely to stocks, and the equity allocation is divided up across many asset classes – small-cap is just one.

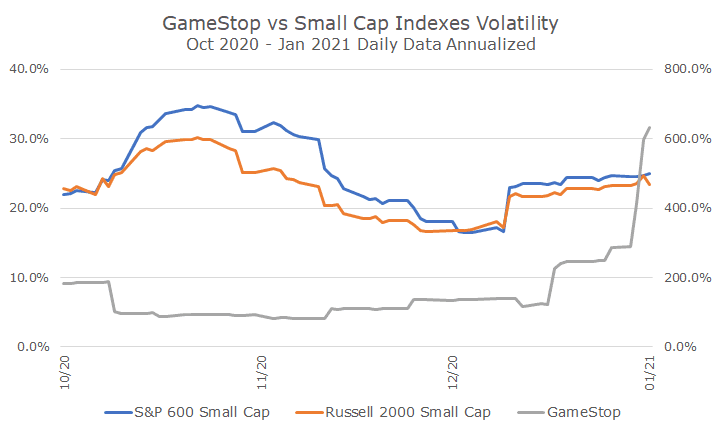

And, even though it’s the biggest position, it’s still well less than five percent. In fact, I pulled up the volatility of both of the small-cap indexes and it’s indistinguishable from normal volatility for those indexes.

If you look at the past few months, the orange and blue lines haven’t changed much, and, in fact, the volatility experienced in the last few weeks is less than it was back in October.

For fun, I put the volatility of GameStop, which is in gray, but the scale was so crazy, that I had to put it on the right axis. That’s right, the realized volatility of GameStop is about 600 percent right now – about 27 times the small-cap indexes. Or, less than a day’s trading from oblivion.

I feel pretty old writing this post, and I had never gone to Reddit before, which made me feel pretty old too. And even though the Robinhood traders are affecting our portfolios, it’s very modest at this point. Still, unlike the SPAC situation, we do have to keep an eye on it since social media trading could become a larger phenomenon.

Oh, and for those of you who debate market efficiency, we can stop using Palm’s stub stock trading larger than 3Com, its parent company in the last 1990s, and just say ‘GameStop’ to the pure market efficiency theorists.