An Arizona State professor, Hendrik Bessembinder, wrote a fascinating paper detailing something that we intuitively sense: a small handful of stocks have created almost all of the wealth over time, and most stocks don’t provide much in the way of returns.

It’s one of the reasons we want hot tips (even when we know they aren’t likely to be hot).

The paper’s provocative title is “Do stocks outperform Treasury bills?” We know from the data that stocks outperform Treasury bills in the aggregate, but his question was how many stocks outperform T-bills, and the answer is surprisingly low.

According to the CRSP database, more than 29,000 publicly traded stocks existed from 1926 through December 2023. The majority of these stocks, 51.6 percent, produced negative cumulative returns. So, right off the bat, we know that more than half of stocks underperformed T-bills.

I would have preferred he had said how many stocks had positive returns less than T-bills, but I didn’t see it (of course, it may be there, and I missed it).

For all stocks with at least one year of data (about 1,000 companies that didn’t last a year), the average return was -9.0 percent. The median return was -0.7 percent, which tells you that some mega returns skew the median and the average). This is the fact that explains the title.

It turns out that the top 1,000 returning stocks account for all of the wealth created in the stock market’s history. The good news is that there were 1,000 of them; the bad news is that it is just 3.5 percent of all stocks.

Narrowing in further, just 86 stocks account for all the wealth created. Wow.

The fun part of the report is various listings of the best-performing stocks in history. Best-performing can mean different things, so he has several lists.

The first list includes the most wealth created, and I can’t name many of the names for regulatory reasons since many of them are on our Approved List. The best one I can mention is Johnson & Johnson, which created 1.2 percent of the market’s wealth.

Others near the top that need to be added to our Approved List include several household names: IBM, Altria, Home Depot, Coca-Cola, etc.

However, those are the top wealth creators, which gives several advantages to companies that started relatively recently. I believe Bessembinder makes an inflation adjustment, but there are still benefits like accessing private markets before going public, technology allowing for scale, etc.

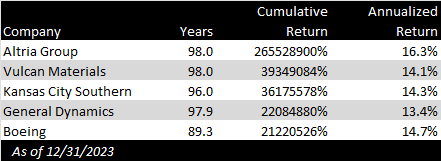

But there is one disadvantage: time. The average lifespan of the ten stocks with the largest cumulative compound returns is almost 97 years. Nvdia, for example, has yet to make the list despite being the best-performing stock of the last twenty years (it’s on a different list).

The stocks with the biggest cumulative returns are:

This list of stocks reminds me of the 92-year-old gas station attendant who left $8 million to charity when he died in 2014. He had a handful of stocks, including Johnson & Johnson, General Electric, and others from the list.

Some people will read this article and the one about gas station attendants and say we should have a concentrated portfolio of the best stocks.

I draw the opposite conclusion. For every gas station attendant who gave millions to charity after owning a few great stocks, there must be 1,000 people who made big bets and lost. That’s why this fellow has been the subject of many articles, including his own Wikipedia page.

Bessembinder’s work shows that you must own a diversified portfolio, knowing that only a few stocks will work out. Too few stocks represent the gains, and you can’t afford to miss them. I would never have bought Nvidia, but I have exposure through an index fund, so I benefited even though I never owned it directly.

Several clients have asked me over the years whether we are ‘too diversified’ with exposure to thousands of companies in our portfolios through index funds. My reply was that there are 500 stocks in the S&P 500, and the academic literature describes how few investors beat the average.

Vanguard’s founder, Jack Bogle, said long before this study that you shouldn’t look for the needle in a haystack but buy the whole haystack instead. Good advice.

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott

- David Ott