As loyal readers know, I am a big fan of 529 savings plans and am a Missouri Most customer on behalf of my two grade school aged daughters.

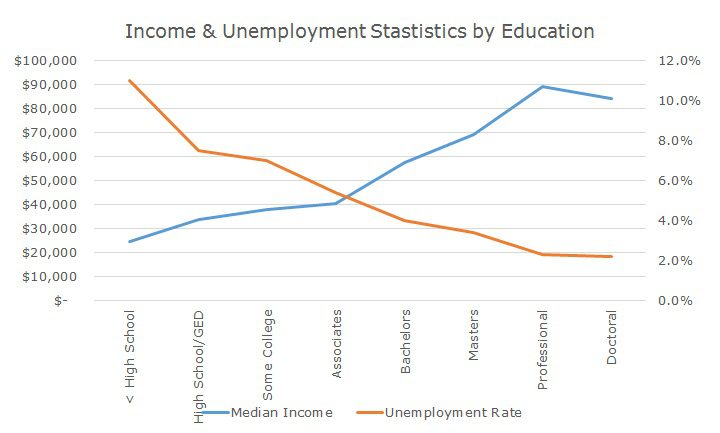

I was reminded of why a high quality education is so important: on average, the unemployment rate declines as education levels increase and incomes increase.

The chart shows that for those who didn’t finish high school, the unemployment rate is 11 percent (indicated in orange) and the median annual income is $24,500. Without exception, as attained education levels increase, the current unemployment rate decreases, although the difference between those holding professional degrees and doctoral degrees is 0.10 percent.

Incomes also steadily rise with incomes with education and the two largest percentage increases come from completing high school (a 37.9 percent increase) and a college degree (a 42.6 percent increase). Unlike the unemployment rate, average incomes actually decline between the professional degrees and doctoral degrees.

My kids are only 9 and 11 so I won’t go over the graph with them yet – I think I will wait until they are actually teenagers, when I’m told they will be open to sifting through a lot of facts and figures with dad.

In the meantime, I looked again at their college savings balances and tried to develop a model that would allow me to figure out if their education is over or underfunded at this point and if they are underfunded, by how much.

As you might expect, I’ve seen a lot of college funding models before and developed some in the past that I wasn’t happy with.

The big problem that I encountered was that if you save too much for college, you’re in a little bit of a pickle because you have to pull the money out of the 529 and pay ordinary income taxes. Saving too much for retirement is no big deal because them money goes to your heirs without any tax penalty (unless you saved more than $10 million, but that’s another story).

It occurred to me that the answer is to not be fully funded and recognize that some of the funding will have to come out of income, which isn’t so bad if you’ve been saving for college – you’re just shifting the name of your spending line item from ‘college savings’ to ‘college spending.’

I have a nice working model now that I am testing and thinking about (ruminating is an important part of the process) and I’ve discovered some newer, equally large problems.

First, I don’t have a good idea of what the college expenses are likely to be at this point. As a father, I naturally hope that they go to Harvard and if they get in, I want to have the money available for them. This year, the sticker price for Harvard is $42,300 and room and board costs $14,100. Sadly, this doesn’t include books, a computer and bumming around money.

I will also be very proud if they go to Mizzou, my mother’s alma mater. And you’ll hear a big sigh of relief coming from my wallet since the costs are radically smaller. In-state tuition is $10,100 and room and board is $9,300.

Over four years, Mizzou will cost $77,600 and Harvard will cost $225,600, a staggering three-fold difference.

How can you plan for that?

It would be one thing if the costs were different by 20 or 25 percent, but the magnitude of the difference is so high that it really makes the model useless.

Over the years, I’ve learned that the key to all models, no matter their purported sophistication, is in the assumptions. I’ve also learned that the ‘answer’ that a model provides is usually less useful than what you learn in the process of creating the model and then having that know-how as you use the model with others.

My conclusion at this point is that it probably doesn’t make sense to exclusively rely on college accounts like 529 plans for college savings. It probably makes more sense to use those accounts to make sure that you have a base level covered, like the cost of an in-state school.

If more money is needed for a more expensive option, it may make sense to simply draw on money that’s been saved in regular taxable accounts. If the money is needed, it’s there and if it isn’t needed, there is no over-savings penalty since it just means more money for retirement or some other goal.