Over the years, I’ve missed some wonderful returns on stocks that I thought were too expensive. I was an Amazon customer starting in 1999 (you can find your ENTIRE purchase history on the site), two years after they went public. I might have missed ‘the ground floor,’ but I was worried about their valuation.

Tesla is another company. I know several people who bought them when they came out, and when I drove one, I couldn’t believe the acceleration when I put the pedal to the metal (in fact, I was so surprised, that I backed off before I hit the metal). And that wasn’t even ‘insane’ mode.

Just three or four years ago, there was legitimate concern that Tesla might go bankrupt. Since the stock isn’t on our Approved List, I don’t follow it closely, but their bonds still carry a junk rating, although they were recently upgraded to BB+.

When it became clear that they weren’t going to go bankrupt, the stock went into insane mode, gaining 743 percent in 2020. And, this year, it’s up another 58 percent and is now one of five companies worth over $1 trillion dollars.

A few clients have asked whether they should buy Tesla now, after the 1,332 percent run-up (yep, that’s right). Of course, even though I thought it was expensive before and missed massive returns, I look at it now and have the same feeling that I did before.

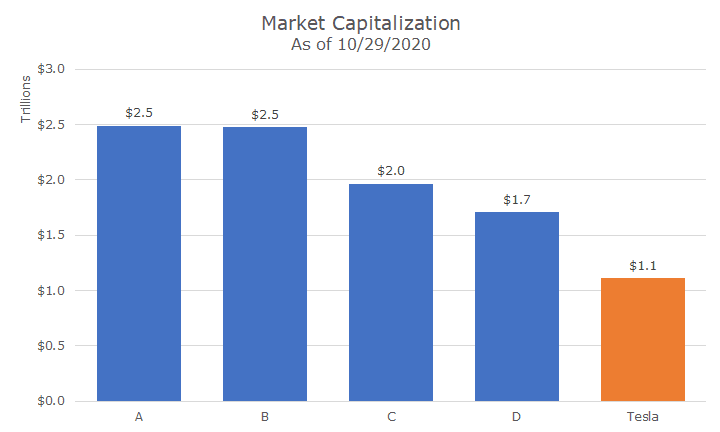

Let’s look at some of Tesla’s fundamentals compared to their financials, starting with the market value. I had to obscure the other names because two of the four are on our Approved List.

First off, I was surprised that two companies in the trillion-dollar club are worth 2.5 times the club’s threshold value.

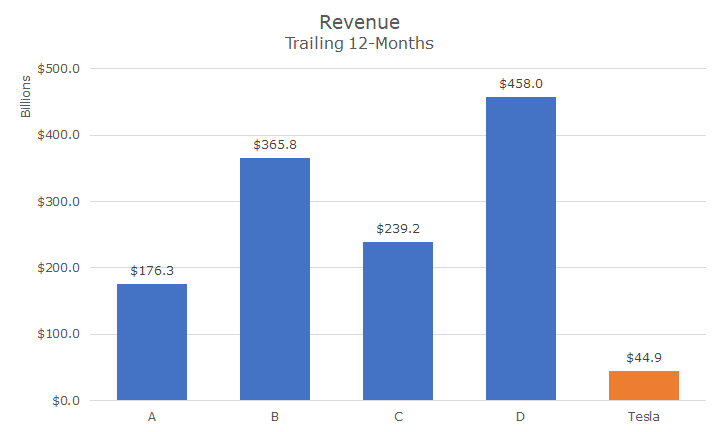

Now, let’s look at the revenue – how much money is coming in the door. You can see that Tesla’s revenue is 90 percent less than Company D, which has the most revenue of the group, and 75 percent less than Company A, which has the least revenue of the five.

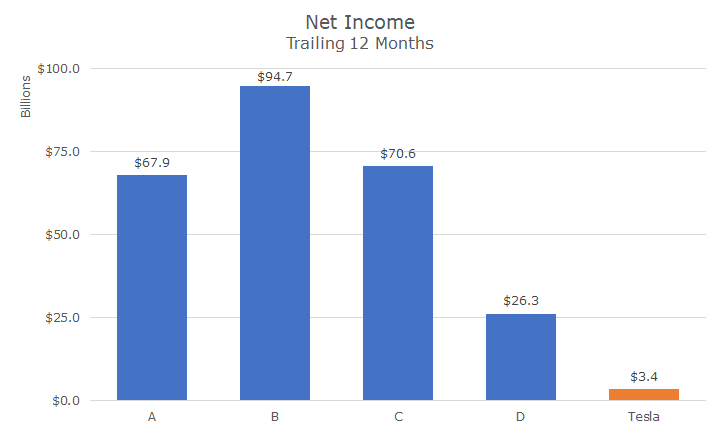

Differences in profitability account for a lot of the variation, so let’s take a look at the net income of the big five. Tesla is making money now, but nothing compared to the other companies in the group. Tesla would have to grow profits 10-fold to get the level of Company D, but that’s the company that has the most revenue, so it may be tricky.

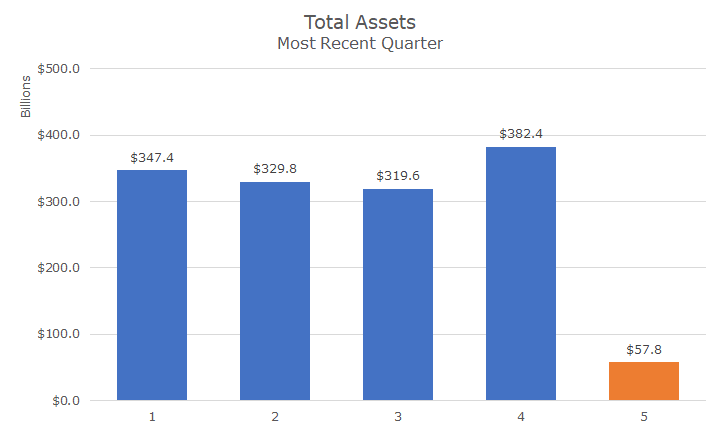

It may be old-fashioned, but I think of the assets as the things that a company uses to make money. The financial assets aren’t a perfect measure, because sometimes assets are brands, processes, or other things that are not line items on the balance sheet.

Still, I thought comparing the assets across the trillionaire’s club would be interesting, and I was surprised by how similar they are (except one).

A lot of times, we talk about ratios like price-to-earnings or price-to-sales, but I think it’s helpful to look at the numbers themselves to compare companies. When I look at the charts above, I still can’t get behind Tesla.

That said, it may continue to be fabulous. I would never short the stock – a lesson I learned in the tech bubble when I thought about shorting Yahoo. I was right that their business model wasn’t great and was overvalued, but I would have gone broke while the stock rocketed higher before sentiment changed.

Thankfully, despite missing Amazon, and now Tesla, I’m still on track to meet my financial goals. Yes, I’d be closer if I’d bought either one, but I would have done it in small doses, so I doubt I’d be much closer.

If I had put 10 percent of my net worth into either one, I’d be a lot richer, but I wouldn’t have slept much and, truthfully, would have cashed out too early anyway. And, if I had done 10 percent into those two, I would have undoubtedly put 10 percent into a few dogs that wouldn’t have helped.

Although I sort of kick myself for missing these, I don’t kick too hard because in the big picture, it doesn’t matter and I’m satisfied that our disciplined process produces attractive results even without the biggest winners.

I’ll continue to be an Amazon customer, and maybe one day I’ll buy a Tesla. They’re beautiful cars!