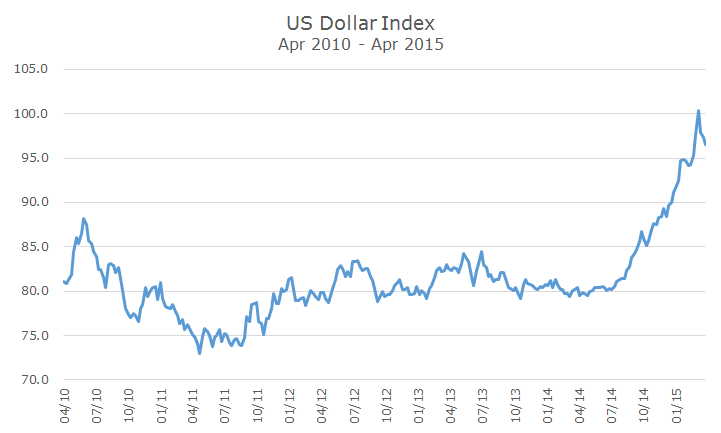

For the most part, the returns associated with foreign stocks and bonds have two components: the return of the stock or bond and, secondly, the return of the foreign currency. Over the past eight months, the impact of the exchange rate has been unusually high.

For example, a German investor that owns an index fund in the DAX is up 24.04 percent so far this year through yesterday. For US investors like us, that return changes when it’s translated back into dollars – the same investment would only have made 8.88 percent over the same time period because the dollar has strengthened so much against the euro.

To capitalize on these differences, Wall Street started launching products that were hedged to the US dollar that wouldn’t experience the gains or losses associated with shifting currency prices. One such product completely changed the fortunes of a relatively small ETF provider and you can be sure that success like that is quickly copied and competition is born.

One of the newer products is a hedged version of the MSCI EAFE index, which is the benchmark that we use for developed non-US stocks. The fund has exploded to $2.28 billion in assets under management, at least partly because the hedged version has done so well versus the unhedged version since its launch a year ago.

Since the dollar rally started eight months ago, the traditional unhedged MSCI EAFE has actually lost value for US investors, losing -0.24 percent. The hedged version of the MSCI EAFE actually gained 15.27 percent, easily outpacing the S&P 500, which gained 5.73 percent over the same period.

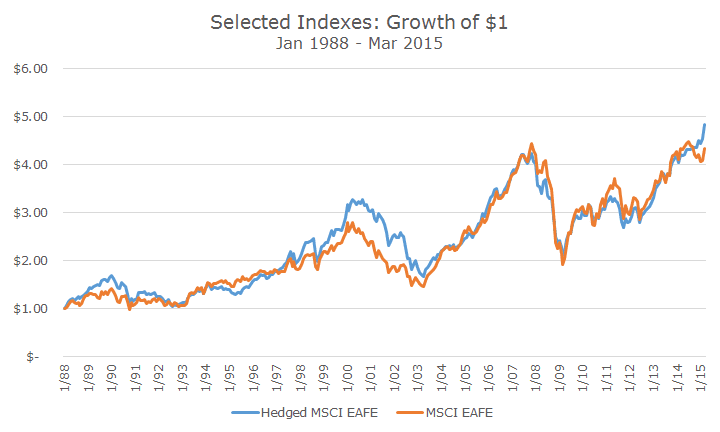

Naturally, returns like that pique my curiosity, so I downloaded the entire index history for the hedged version, which goes back to 1988. As the chart below basically shows, the overall impact of hedging is minimal over time.

Outside of the current dollar rally, the only other period where it made a difference was in the late 1990s when the US dollar was very strong. All of that outperformance dissipated in a relatively short time period.

It’s true that, at this point, the hedged version has slightly outpaced the unhedged version, you can attribute all of the extra return to the current rally. In statistical terms, I can only say with 10 percent confidence that the returns are different, so while it looks good right now, there’s a great chance that it won’t mean a thing in relatively short order.

Since I can’t tell the difference in returns between the two, I thought about other attributes that are important to investors. One of the reasons that we invest overseas is diversification, which can be measured by the correlation of an index versus the S&P 500.

As you might expect, the correlations are similar, but the unhedged version is slightly lower exactly because of the currency exposure.

Because the performance differences are so small over time, the lower correlation is enough for me to want to stick with the unhedged version, but I have to concede that it’s not really impactful either way.

Then it occurred to me that it will cost more to buy a hedged product than an unhedged one because the ETF manager has additional work to do and can charge more for their value-added contribution, which I think is fair.

Although I didn’t do an exhaustive search, the main provider in this area (the one with $2.28 billion in assets) charges 0.40 percent per year. The product that we use to get our main beta exposure costs 0.05 percent (I’m not including a non-US stock fund that we use for size and value exposure that is decidedly more expensive but not really comparable).

To me, if you expect the gross return to be basically the same over time, even with some differences along the way, you want the cheaper product. In a frictionless world, I think I’m indifferent with a slight bias towards unhedged, but in the real world where costs matter, I’ll take the cheaper unhedged version.