Ten years ago, I wrote about a new book by one of my favorite authors, Michael Lewis, who went on 60 Minutes and declared that the market was rigged.

Here’s what I wrote back then: The Market is Not Rigged.

I knew that he was making outrageous claims to sell his book, but people were scared by his comments.

The book in question, Flash Boys, was fun and interesting. It followed a small group of high-frequency traders who wrote such fast and clever software that they could pull money out of the market by getting in between buyers and sellers.

There was nothing new about that; market makers have existed for over a century. The novelty was how much money these specialized traders made and the lengths they would go to get an edge on their competitors.

Even though I knew the market wasn’t rigged, I decided to hire an outside firm to measure the market impact of our trades. I wanted to know just how much market makers earned on our trades.

The answer: something, not very much.

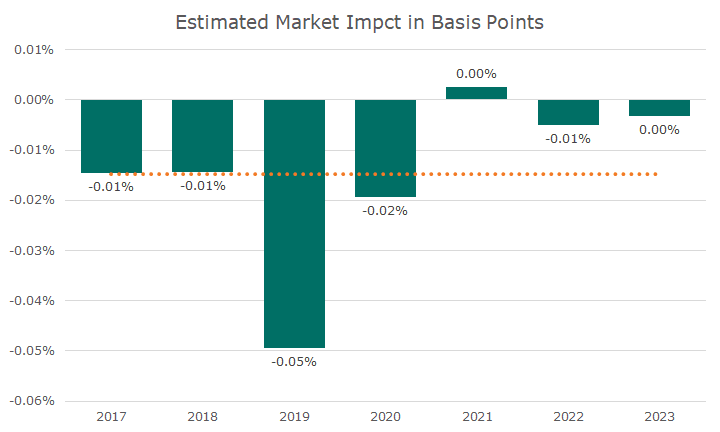

The chart below tells the story. A basis point is one-hundredth of one percent, and it says that market makers make a little bit of money on our trades, about 1.5 one-hundredths of a percent (or 1.5 basis points).

According to the newest report, we traded a little more than $1 billion in stocks and exchange-traded funds last year. That’s an astonishingly large amount, in my opinion, and the report suggests that the market impact was about $35k.

Of course, there are some caveats. The firm we hired takes all of our trading data for the year and uses their model to estimate the market impact. We know the report isn’t exactly right, but it gives us a reasonable estimate.

I’m not confident, for example, that we made money trading in 2021, even though that’s what the report estimates. It’s possible, and I can’t prove anything one way or another, but when I look at the whole report, my conclusion is that, overall, the market isn’t making much on our trading.

I expect market makers to profit – why would they be market makers if they didn’t? We just don’t want them to make too much because their profit comes out of the client’s pockets.

We use the report with regulars to show that we get what is called ‘best execution,’ along with reports from Schwab, where we do most of the trades.

I’m impressed that they’ve averaged almost 30,000 trades per year over the last four years and achieved such great execution. They also make a tiny number of errors, about 40 per year over the same period.

A lot goes into their work, and I am deeply grateful for the effectiveness, efficiency, and speed at which they work, especially when market conditions are choppy. Thank you, traders!