I’m a little embarrassed to admit that I’m not really following what’s happening in the Ukraine. I know that the people were unhappy, they protested, the President was ousted and Russia is involved.

The only story that really caught my attention was that when they raided the President’s house, they found a palace, a golf course, a private zoo and, oddly, a replica of an old ship with a restaurant. It sounded like Michael Jackson’s Neverland Ranch.

Here are some pictures, and I must say, the Ukrainian people must be great since they are just touring the grounds instead of destroying and looting them.

I thought that some clients might call to ask what their exposure to Ukrainian stocks are and since no one has inquired as of yet, I thought I would proactively report that our exposure is exactly nothing.

While we do invest overseas, we limit our investments to developed and emerging markets. Developed markets include countries like Japan, the UK, German, France, etc. Emerging markets are countries like China, Taiwan, Brazil, India, etc.

These definitions are a bit soft and there are some disagreements about some countries. For example, the index provider MSCI says that S. Korea is an emerging market while FTSE says that it’s a developed market. (We use FTSE indexes and we have two S. Korean employees, so we naturally think it’s a developed market.)

In academia, a general litmus test to determine whether a country should be classified as developed or emerging is by looking at the gross domestic product (GDP) on a per capita basis. Anything over $25,000 in US dollars is developed and anything less is emerging.

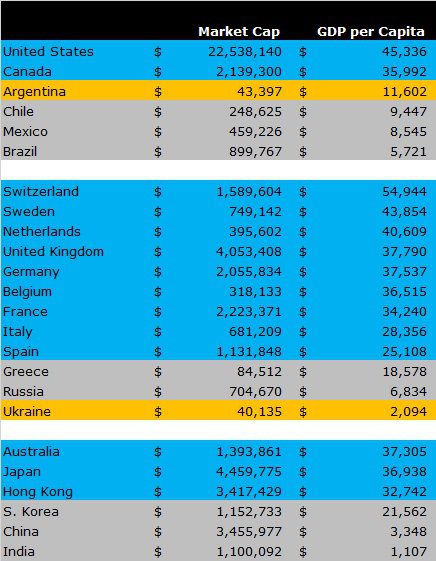

I compiled the data from Bloomberg and the results neatly matched the economic definition that I had read and provided some interesting additional insight. In the table, the countries colored in blue are developed and grey are emerging.

The first column is the value of each country’s stock market in US dollars, for comparison purposes. As you can see, we dominate the list with a $22.5 trillion market. The next contenders, Japan, Great Britain and Hong Kong are $3-4 trillion.

The second column shows the GDP-per-capita in US dollar terms. These are more staggering in my mind because you can really see just how wealthy a few countries are. In these terms, we only rank, second, behind Switzerland and there are a few contendors right on our heels.

But look at the GDP per capita of the BRIC countries: Brazil, Russia, India and China. They range from just $1,100 of GDP per capita in India to $6,800 of GDP per capita in Russia. Obviously NBC highlighted the good things in Sochi, but to think that Russia is 85 percent smaller in GDP per capita is amazing to me. The market capitalization of their stock market is 96 percent smaller, which is even more amazing.

I also think it’s interesting to see how close Spain is to becoming an emerging market. Greece was downgraded last year due to the financial crisis, but the GDP per capita is three times larger than Russia’s. Interestingly the market capitalization for Greek stocks is about one-tenth of Russian stocks which would imply that we should buy Greek stocks, but that doesn’t seem overly appealing.

As for the disagreement about S. Korea, the GDP per capita test would suggest that despite their triumphs, they should be classified as emerging still. The highlights are based on the MSCI classifications, which still has them as such.

The two countries highlighted in orange are not developed or emerging, they’re considered ‘frontier’ markets. Some people say that they’re the ‘new’ emerging markets stocks, but at this point Acropolis isn’t interested. Other countries with frontier markets include: Trinidad, Kazakhstan, Nigeria and Pakistan, although most of the money is in Kuwait, Qatar and the UAE.

Of course, my favorite thing looking at the table is seeing that while the US is second in GDP on a per capita basis, we dominate overall. Our GDP is $16 trillion compared to $631 billion for Switzerland – it’s a lot easier to get your per-capita numbers up when your population is $8 million, which is a little less than New York City’s population (and not even the metro area, which has 19.8 million people).

The Ukrainians have 45 million people and I hope they settle their problems over there, for their sake. In the meantime, I’m not going to worry about how the unrest will affect my portfolio – the value of their entire stock market is about the size of Apple’s profits last year.