With the Federal Reserve now unwinding their bond purchasing program known as quantitative easing, it’s likely that the Fed will start to raise short-term interest rates at the end of 2015 or the beginning of 2016 (assuming no new information).

Now that we ‘know’ that the Fed will raise rates, what will happen when interest rates rise? The short answer is that it depends. I know that’s an unsatisfying answer, but it’s really true!

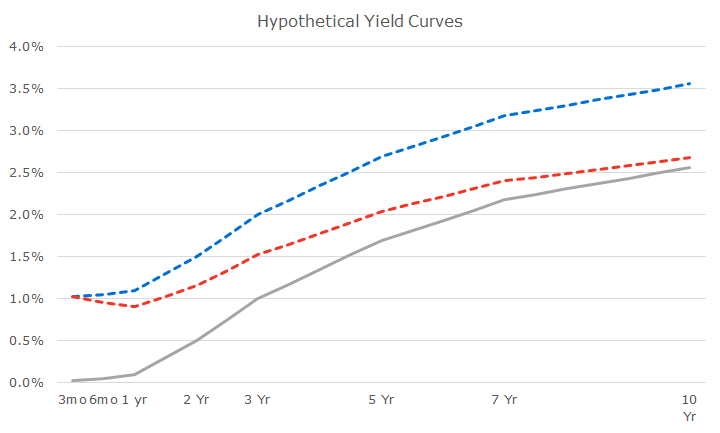

Let’s start by looking at the following series of hypothetical yield curves:

The first one, indicated in gray is the closest to reality. For the various years labeled on the x-axis, I used today’s Treasury rates. The curve isn’t perfect, though, because I made up the rates where there aren’t specific labels. I used a common ‘interpolation’ technique, so it’s ‘k’ for close, but not perfect, but that’s OK.

The blue dotted line shows what the yield curve would look like if all interest rates rose by exactly one percentage point, or 100 basis points (or bps). In this hypothetical, every segment of the curve moves equally and is known as a ‘parallel shift.’ It’s also pretty unrealistic, but I’ll get back to that in a moment.

The red dotted line shows a possible outcome known as a ‘bear flattener.’ The bond market has a lot of funny terms, but the key to this hypothetical is that short-term rates raise more than long-term rates. In this example, I made up the curve and, no, it’s not a prediction or forecast!

A commonly used rule of thumb in bondland is to say that if interest rates go up or down by one percent, a bond will lose or gain in price by the length of the term.

I am going to oversimplify here (a lot), but the idea is that if interest rates go up by 100 bps, a one-year bond would lose one percent, a five-year bond would lose five percent and a 10-year bond would lose 10 percent. If rates fell by 100 basis points, bonds would gain by the equivalent amount.

A lot of people take that rule of thumb and say that if the Fed raises interests by 100 bps, then the bond market will fall five percent (since, to oversimplify, it has a five year term). The trouble with this analysis is that it assumes a parallel shift, as shown by the blue line.

If instead, we get a bear flattener, where short term rates go up but rates are essentially unchanged in the five year part of the curve, the impact won’t be so dramatic.

One of the things that I have learned over the years is that the bond market is full of twists and turns. The slope of the yield curve changes by different amounts at different times and this analysis doesn’t factor in other kinds of changes, like the difference in yield between corporate bonds and Treasury bonds.

As usual, it’s difficult to predict the future, but in my humble opinion, a bear flattener is more likely than a parallel shift, which really doesn’t happen in practice. If the curve flattens out, then owning a term similar to the Aggregate will provide a much better payoff than a short-term bond.

For this reason, we are content to continue to keep our bond exposures slightly shorter in term than the overall market, but not by much.

More importantly, we just don’t know what’s going to happen in the future. I said the same thing about stocks for the past two days and it’s true for the bond market as well. This year, although it isn’t over, is a perfect example. Everyone thought that rates would increase this year, including us, and instead they have dropped sharply.

So the next time someone says that bonds will get killed when the Fed starts raising rates, you can comfortably say, ‘not necessarily’ with a smile!