Last Thursday, Mario Draghi, the President of the European Central Bank (ECB) disappointed markets by not increasing their current bond buying program.

It was a shock to markets, although you wouldn’t really know it from looking at the stock market. The S&P 500 lost -1.44 percent, and while that’s a fair amount, it definitely falls in the normal category and not in the shocking category.

The real action was in the bond and currency markets where we saw what traders call a ‘reversal.’ It’s well known that markets often create trends and a reversal simply reflects the conclusion of a trend.

In the weeks ahead of the ECB meeting, the euro was getting weaker versus the dollar because quantitative easing weakens the dollar, just like lowering interest rates.

Additionally, markets were pushing up European bond prices (especially at the short end of the curve), which means that yields were falling.

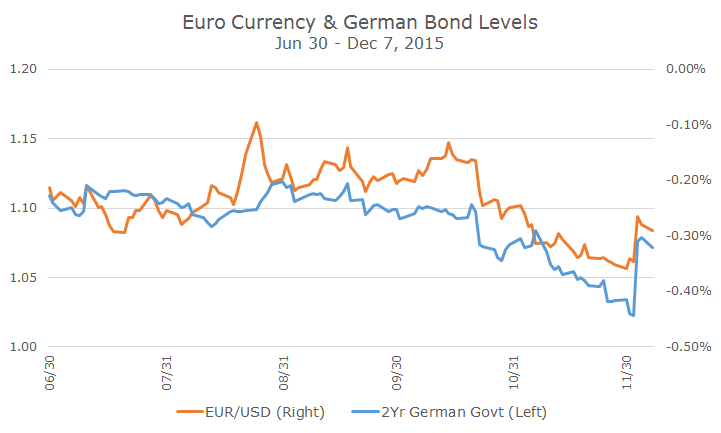

The following chart shows the euro (versus the dollar) and the yield on the two-year German government bond (euro on the right axis in orange and the German bond on the left axis in blue).

You can clearly see the trend starting around the beginning of the quarter as the euro got weaker while German bond yields fell. Then, when the ECB failed to deliver, the two trends reversed course sharply, bringing the levels almost all the way back to the quarter-end levels.

For us, this wasn’t really a big deal because we aren’t really trend followers. Some strategies, managed futures being the most obvious, are based exclusively on trend following and they really got hurt last Thursday.

Managed futures funds attempt to catch trends by buying what has gone up recently and selling short assets that have fallen recently. Going into the meeting, they were short euros and long German bonds (among other things) and were hit with a tough reversal.

The Newedge Trend Index, an equally weighted index of large managed futures managers, lost -3.66 percent on Thursday, wiping out all of the gains for that index for the year.

Although we haven’t really invested in managed futures programs, we have been looking into them over the past several years. I’ve experimented with them in my own account, which often serves as an incubator for investment ideas (click here for more details), and still have an allocation.

Sadly for me and my family, we fared much worse than the Newedge trend index last week (that incubator situation is definitely for better and for worse).

We’re not opposed to managed futures and trend following, but we don’t feel like anyone understands them like traditional asset classes like stocks and bonds. Managed futures strategies were born in the 1970s, but didn’t really get big until the last 10-15 years or so.

By comparison, there is good data on stocks and bonds that goes back to the 1800s for the US and many decades from countries all over the world.

As always, we’ll keep looking and learning, just like we did last Thursday.