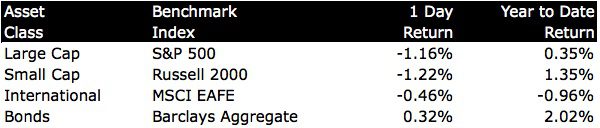

Markets closed lower on Friday, but were up strongly for the week.

The S&P 500 was up 1.38 percent, the Russell 2000 was up 1.04 percent, the MSCI ACWI ex US was up 0.23 percent and the Barclays Aggregate bond index was up 0.18 percent last week.

Please note that I’ve made an index change from the MSCI EAFE to the MSCI ACWI ex US index starting today. The reason for the change is partly because my data source changed, and because the ACWI ex US better reflects what’s happening to stocks outside of our borders.

The MSCI EAFE only tracks large cap stocks in the developed world (Japan, Britain, France, but excluding Canada, oddly) and the MSCI ACWI ex US tracks captures the entire investible universe of large, mid and small cap stocks in 22 developed markets and 21 emerging markets.

With more than 6,000 stocks, it represents more than 99 percent of stocks outside of the US.

I didn’t watch much CNBC on vacation last week, but I did see Fed Chair Janet Yellen’s first FOMC announcement and Q&A session.

The ‘small’ news was that the FOMC continued to wind-down their long-running quantitative easing program by another $10 billion per month. The program, which reached $85 billion per month in bond purchases will fall to $55 billion per month starting in April.

The ‘big’ news was that Janet Yellen provided more information than markets were expecting by defining ‘considerable period’ in loose terms.

Since the Fed started winding down their bond buying program, investors have assumed that the Fed would reduce their monthly purchases by $10 billion per month and, so far, the Fed has been right on track.

At this pace, the bond-buying program will be finished by the end of this year. The Fed has previously said and reaffirmed in their most recent statement that they will maintain ‘a highly accommodative stance of monetary policy for a considerable time after the asset purchase program ends’

During the Q&A, reporters asked for clarification on what ‘considerable time’ is and she stumbled around a little verbally and ultimately said ‘something on the order of six months.’

Until that moment, markets were higher, but when she said ‘six months’ stocks dropped and bonds rose.

While a lot of investors believed that the Fed wouldn’t raise interest rates until the second half of 2015 or early 2016, the timetable moved up to the middle of 2015.

While pundits spent the next two days talking about whether she made a mistake or not, I personally didn’t think much of the supposed gaffe. It reminds me of the taper, when markets (including me) were ‘sure’ that the Fed would slow their bond purchases starting in September of last year. Instead, they waited until December. In the long run, what’s the difference?

Second, I think that the more transparency from the Fed is good. It’s unclear whether she intended to be this lucid, but we’ve got a busy week coming up with Fed heads on the speaking circuit. By Wednesday, we’ll have heard from Stein, Lockhart, Plosser and Bullard and I’m sure that one or more of them will offer additional clarification.

As to the question of how Yellen did in her first appearance of Fed Chair, I thought she did really well and that the ‘gaffe’ wasn’t a big deal. I remember when Bernanke first took over, his voice wavered and he seemed really nervous.

In the end, that didn’t matter, since his mettle was tested less than two years later in the financial crisis. Still, it’s nice to see Yellen speak with confidence, with a bit of a tough Brooklyn accent.