The Wall Street Journal had a headline yesterday that I couldn’t resist: Junk Bonds Deserve a Place in Investors’ Portfolio.

I like to read articles where I agree with the fundamental proposition, but I REALLY like to read articles where the premise completely contradicts my view, or the view of Acropolis.

This article falls in the second category since we believe that junk bonds don’t deserve a place in your portfolio.

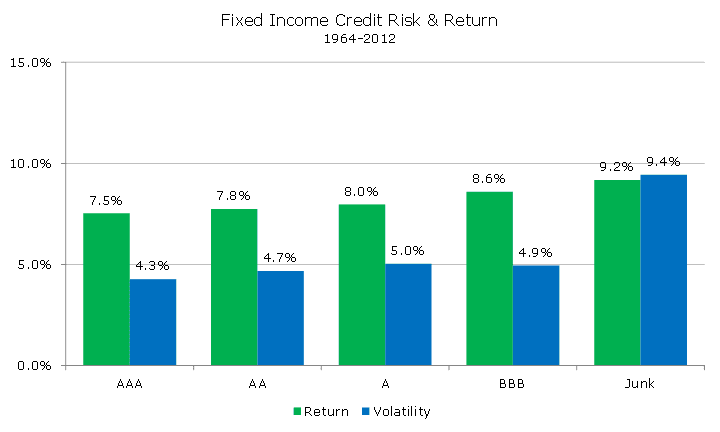

It’s true that over the long-term, junk bonds have outperformed other bonds with credit risk. The following chart shows the risk/return characteristics for corporate bonds by their credit ranking from 1962-2012 according to Barclays. At some point, I will need to get updated data, but the story is unchanged in the last 18 months.

As theory would predict, the least risky assets, AAA corporate bonds, earned the lowest return and had the least volatility. As the credit quality of the bonds decreased, the returns increased, as did the volatility, albeit marginally (except for from A to BBB, but that’s probably a statistical anomaly.

In any case, the risk-return ratio stays basically the same throughout the investment grade bond universe.

Notice that for non-investment grade bonds, or ‘junk’ bonds, the return is higher, but the volatility is twice as high. Where the investment grade bonds essentially earned 1.75 percent in return for each percentage point of volatility, that ratio drops dramatically to a roughly 1:1 ratio for junk bonds.

In other words, the risk return trade off is much different for junk bonds than it is for investment grade bonds.

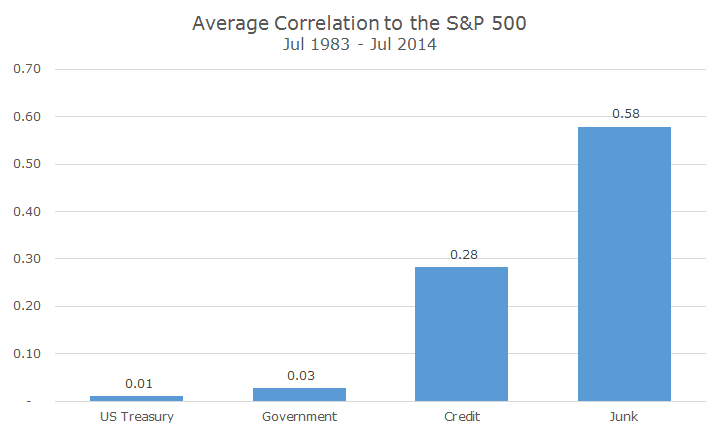

The bigger issue with junk bonds in our view, however, is that they are highly correlated with stocks. Stocks and bonds work well together because their returns are largely unrelated to each other, or uncorrelated in fancy terms.

The lower the correlation between assets, the better the diversification. The following charts show that the relationship between stocks and US Treasury bonds is effectively zero – they’re completely unrelated. The same is true for other government bonds.

Investment grade bonds, labeled credit in the chart, are more correlated with stock, but are still reasonably low. Junk bonds are nearly twice as correlated to stocks as regular investment grade corporate bonds, which is just too high in our judgement.

If the correlation jargon isn’t working for you, consider this: during the financial crisis, when stocks fell 37 percent in 2008, junk bonds fell by more than 28 percent while the Barclays Aggregate Bond index (which is entirely investment grade), gained 5.25 percent.

In other words, when markets turn down, and they always will, junk bonds will suffer along with them just at the time you want your bond portfolio to keep you safe.

This isn’t unique to junk bonds either – the same risk/return properties are found in other bonds with a lot of credit risk like convertible bonds, emerging markets bonds, bank loans and preferred stock.

These aren’t inherently bad asset classes, they just don’t draw the bright line between stocks and bonds that we want to provide. We think that the vivid distinction provides for better diversification especially in the heat of a downturn.