If you pay quarterly taxes, they’re due today! The next payment isn’t until January 15th of next year, but it probably makes sense to start salting away money now so that you’ll have plenty on hand in a few months. If you aren’t sure whether or not you need to pay quarterly taxes, you probably don’t.

The quarterly taxes are actually estimated tax payments on income that is not subject to withholding.

Estimated taxes are generally paid if you are a sole proprietor, partner, or corporation shareholder although anyone can owe estimated payments if the income tax being withheld from your salary, pension or other income isn’t enough to cover the income you earn from interest, dividends, alimony, rent, capital gains, etc.

If you’re wondering where all of that tax money goes, there are a few sources online that show how the government spends our money, although I have the distinct feeling that all of the ones that make it easy to understand are partisan.

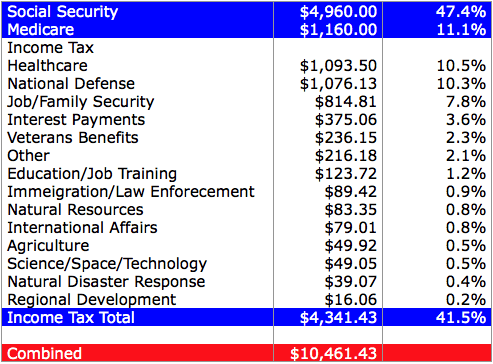

The following data is from a calculator created by the White House (so it’s certain to be partisan, as you would expect from any administration) and shows a ‘receipt’ for your tax payment, which is a nice idea, actually.

In the calculator, found here, I chose one of the pre-selected scenarios, which was for a married couple with two children in 2013 that contributes five percent of their wages to a 401(k), does not itemize and claims the Child Tax Credit. (Perhaps not surprisingly, there was no option for a one-percenter.)

So there it is, folks, your government dollars at work (not including city or state income taxes). A big tax bill is what I call a high class problem – it stinks, but it’s better than not having a big tax bill.

And if that doesn’t make you feel better, I used patriotic colors in the table…