Twice per year, Standard & Poor’s issues a report that compares the performance of actively managed mutual funds to corresponding S&P indexes. The most recent report, the S&P Indexes Versus Active, or SPIVA, can be found here.

It’s a great report because it provided high quality, continuous evidence in the ongoing debate about active versus passive management.

The debate, which has being going on for 30+ years, centers on who can deliver superior returns: active managers who study the market, scour through SEC filing and make projections about the economy, or passive managers that are content to simply own the market in a low cost index fund.

The most recent batch of data, courtesy of the SPIVA report, deals another winning hand to passive managers.

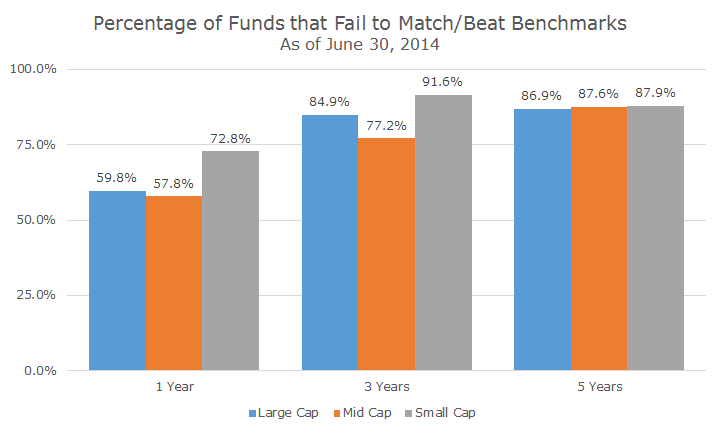

The first chart shows the percentage of actively managed funds that fail to beat the corresponding S&P benchmarks. So, nearly 60 percent of large cap funds failed to match or beat the S&P 500 over the past year.

Over the five years ending on June 30th, the percentage of actively managed mutual funds that failed to beat the matching S&P index (large, mid or small) was a staggering 87 percent. In the short run, the results are only slightly better than a coin toss, but going out five years, the odds were severely stacked against finding a fund that beat the index.

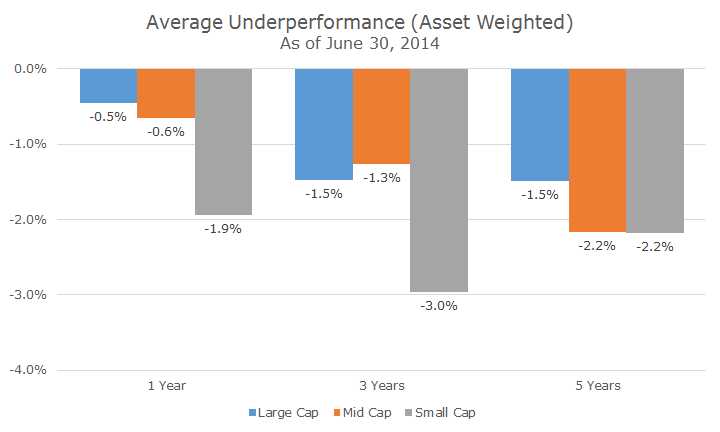

So the odds of finding a winning fund were low, but how bad were the losing funds on average? Pretty bad, it turns out, depending on the asset class in question.

The best results were for large cap stock investors who earned 24.16 percent in actively managed mutual funds compared to 24.62 percent for the S&P 500.

In annual terms, the worst case scenario was for small cap funds over the past three years, who underperformed the S&P 600 small cap index by an average of three percentage points per year.

That isn’t the worst cumulative result, though, since the 2.2 percent loss per year on small cap funds versus the S&P 600 was 11.39 percent over the five years ending in June. Losing three percent for three years is only a nine percent underperformance – those two extra years are tough on cumulative returns.

I frequently hear that active managers have better opportunities in small cap stocks because markets are less efficient.

This idea doesn’t ring true to me whether it’s small cap, emerging markets, REITs or some other narrow asset class and this data doesn’t even come close to supporting that conclusion (the full report shows that actively managed REIT and emerging markets also underperformed the indexes).

One drawback of the SPIVA report is that it doesn’t sufficiently cover non-US stocks. There is a brief section on non-US stocks, but S&P’s funds are not compressive overseas, which is why most investors look to other benchmark providers like MSCI and FTSE for non-US indexes.

In my opinion, the actively managed fund community would look at this report and say that this five year period is unique – it was a straight up bull market and while caution may have been warranted with excess cash holdings or defensive stocks, it didn’t pay off.

This group of folks, rightly or wrongly, tends to argue that stocks were bailed out by the Federal Reserve and this five year period of time isn’t reflective of true long-term results.

I would have more sympathy for this argument except that old SPIVA reports which can be found with a simple Google search show that actively managed mutual funds fared very poorly in the Tech Wreck and the 2008 Financial Crisis.

The 2008 report, which can be found here, shows that 72 percent of active large managers underperformed the S&P 500 in the five years ending on Dec 31, 2008 by 0.75 percent per year. You could say that actively managed funds did better in a period that included a bear market, but it was still worse than a simple index.

It seems fairly clear to me that passively managed funds are the way to go here. Within the passively managed fund universe, though, I would definitely include ‘factor’ funds that weight towards strategies like value, momentum, size, quality, etc.

Academics can (and do) argue about whether these factor funds are active or passive since they are process-driven and don’t have managers, but don’t necessarily track indexes either. It’s an interesting argument, but we don’t operate in an ivory tower and have to actually make investing decisions.

I tend to think that if you like index funds, you’ll love factor related funds, but in either case, it’s easy to agree that traditional, actively managed mutual funds have been difficult to like in recent years.