Years ago, before the crisis, I read a terrific book by investor Joel Greenblatt titled, ‘You Can Be a Stock Market Genius: Uncover the Secret Hiding Places of Stock Market Profits.’

Usually a title like that is a turn off for me because it implies that investing is easy and that someone’s behind the curtain who knows the secrets to making money that no one else knows.

Despite the title, I read the book anyway, because Greenblatt has an excellent reputation as a hedge fund manager and I had read that the returns for his fund between 1985 and 1995 was around 50 percent (before fees, which were substantial, but still, that’s high).

The book actually details, in a very fun way, some of the odd special situations that are fairly well-known within the investment community. They have odd names like spin-offs, merger arbitrage, rights offerings, recapitalizations, stub stocks LEAPs and warrants.

Despite the odd nomenclature, all of the schemes are collectively known as ‘event-driven’ strategies, which simply means that something is happening, like a merger that alters the normally efficient market protocol, although it’s usually for relatively short periods.

We experimented with spin-offs prior to the 2008 crisis, which are basically stocks that ‘spin-off’ a smaller division that become independent companies. A recent example is CBS, the media company (or Channel 4 here in St. Louis) spun off CBS Outdoor Americas, which owns billboards along the highway.

Usually, the management of the parent company (CBS in this example) wants to focus on their core business and feel like the market isn’t properly valuing the business segment that gets spun off.

A well-known academic paper, ‘Restructuring Through Spinoffs,’ written in 1993, showed that the spun off companies tended to outperform the S&P 500 for about 10 percent per year in the first three years as an independent company.

Our small experiment didn’t turn out well, largely because we didn’t have enough companies to create a diversified pool of spinoffs and we had one that fell apart as an independent company that essentially ruined the strategy for us. At about that time, the crisis was heating up, so we abandoned the approach and stuck with our traditional knitting for our individual stock selections.

Spinoffs are in the news recently, because, on average, they are having a tough time this year compared to the overall market and it’s hurting the performance of hedge funds.

Since I haven’t given spinoffs much thought since our experience seven years ago (or so), I decided to see if there were any exchange traded funds (ETFs) that focus on spin offs since there seems to be an ETF for any occasion.

Indeed, the Guggenheim Spin-Off ETF (ticker CSD) was launched in late 2006, about the time we got out.

Since it’s a diversified approach, I was interested to see that the ETF has out-out-performed the S&P 500 by about 2.3 percent per year. That’s a far cry from the 10 percent that the study found, but that makes some sense since the strategies are better known today than they were in 1993, when the original study was completed.

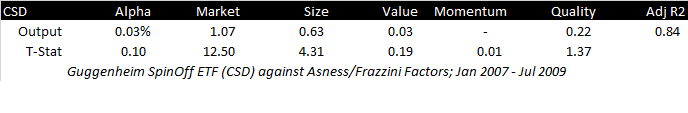

I decided to take the returns and run them through our models to see whether the excess return was the result of something special (alpha) or could be explained by other, traditional factors (size, value, etc.).

It turns out that the alpha was basically zero. Nothing. Nada. The big goose egg. There was nothing special about this spin-off based ETF. Almost all of the excess returns could be explained by the fact that spinoffs tend to be smaller than the overall market, and during this particular period, small cap stocks outperformed large cap stocks. (I’ve included the statistics below for the geeks out there.)

Right now, the average market capitalization of the stocks in the spin-off ETF is $5 billion, which is basically a mid-cap fund.

If we compare the spin-off fund to the S&P 400 Mid Cap index, the results are identical – 8.93 percent for the spin-off ETF and 8.73 percent for the S&P 400 Mid Cap index (Dec 2006 – Sep 2014). The 0.20 percent difference is pure noise – if we had checked last month, we would have seen that the S&P 400 was ahead.

So, another magic money machine is out the window. Greenblatt must not have told the full story in his book – and why would he? He still manages money today and if you’ve got secrets, it’s best not to share them.

Although our foray into spinoffs was small, I wish that we had the tools back then that we have today. To quote the 1973 Faces song Ooh La La, ‘I wish that I knew what I know now, when I was younger.’ (Click here to listen the song and see a very young Rod Stewart.)

Special Nerd Section: