Bond investors were expecting a lemon going into 2014 and got lemonade instead.

Institutional investors tend to look down their noses at ‘retail’ investors, but they are frequently guilty of the same problems, which in this case, was recency.

In general, recency refers to applying what’s happened in the recent past into the indefinite future. For bond prognosticators, interest rates rose and bond prices fell in 2013, so it was all too easy to say that the trend would continue into 2014.

Instead, interest rates fell and bond prices rose, much to the surprise of most investors. In October, I wrote (for the second time last year) that yields were not following the forecasts at all (click here for the article with a nice graphic), and, since then, yields fell further.

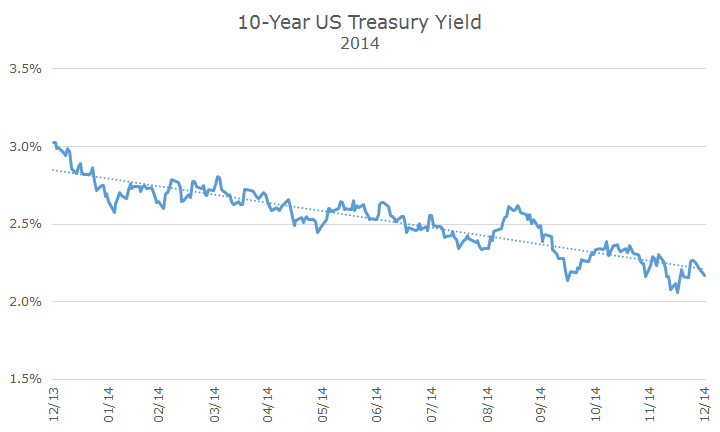

Here is a graph charting the course of the 10-year US Government bond yield in 2014.

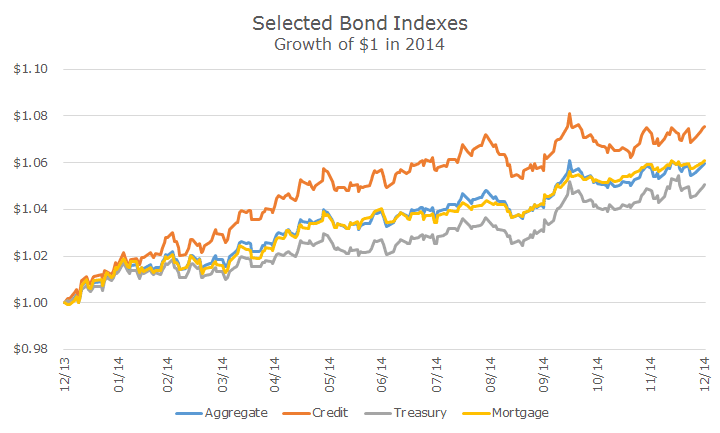

As a result, bond prices rose. The following chart shows the daily performance of the Barclays Aggregate (Agg) and its three major subsectors, Treasury bonds, mortgage backed securities (MBS) and corporate bonds (technically referred to as credit).

To put last year’s returns into perspective, I analyzed the monthly returns for the Agg since its inception in January 1976. Then, I calculated the returns for all of the 12-month periods from the inception through December and found that the average 12 month return was 8.05 percent, which is a little better than the 5.96 percent that the Agg earned last year.

Last year’s result was in the 43rd percentile, so even though it was average, it’s still around the average. Interestingly, the best return for the Agg was 35.19 percent in the 12-months ending in September 1982 and the worst 12-month period was -9.20 percent ending in March, 1980.

While I was looking at this data, it occurred to me that the average return is somewhat higher than today’s return because interest rates were mostly higher in the period since the Agg was created.

I thought it would be more interesting, therefore, to look at the average ‘excess’ return of the Agg over one-month US treasury bills, a proxy for cash. (I wanted to do the same thing with inflation, but was having data problems – future article, I promise!).

Looking at the excess return of the Agg over Bills was a different story. Last year, the excess return was 5.95 percent, which is only two one hundredths of a percent different than the nominal (non-excess) return. The average excess return since 1976 is 3.00 percent, meaning that 2014 was much better than average – in the 71st percentile, actually.

Of course, going back to the concept of recency, that doesn’t mean next year will be as good, or even positive for that matter. We just don’t know. Like stocks, bond market returns are unpredictable. In fancy terms, there is no autocorrelation in returns, which means that returns from one period to the next are random (for more on this topic, click here).

Bloomberg does a survey of professional investors, and the median forecast among the 76 firms that provide information calls for the 10-year US Treasury yield to rise to 3.01 percent. The highest forecast calls for 4.20 percent and the low forecast is 2.40 percent.

Given that yields are at 2.04 percent today, that means that everyone surveyed is calling for higher rates.

One famous bond investor, Jeff Gundlach, dubbed the new ‘bond king’ now that Bill Gross has been dethroned, thinks that the yield on the 10-year will fall below one percent. He’s got a doomsday scenario to go with that – and who knows – he may be right. His performance has been outstanding over the past five years, but he could be wrong too.

Given the uncertainty about the direction of interest rates, we don’t think it makes sense to make big bets one way or another. In years past, we kept a very short-term portfolio to insulate us against losses if interest rates rose, but the opportunity cost of being short term and wrong as rates fell was costly.

If we had done that last year and owned the short-term Barclays index with a duration of ~2.5-2.75 years, our performance would have been around 1.40 percent, underperforming the Agg by approximately 4.5 percent. For more on this subject, click here.

While we don’t know where yields are headed in the short-term, the best proxy for future returns is the current interest rate environment. So while we can’t say whether 2015 will bring gains or losses, we can say that returns around two percent on bonds for the next decade is entirely reasonable.

Still, it’s days like yesterday that make you glad that you have bonds in your portfolio. Although expected returns may be low, inflation expectations are also low and bonds are still almost always required in a portfolio to dampen volatility.