Maybe I’m a little hung-up on this, but I am always a little annoyed when institutional investors look down their noses on retail investors.

When a bull market is finally getting going, you’ll hear them sniff that ‘retail is finally waking up,’ or when markets are falling, they’ll say that the losses are exaggerated because retail is selling into the downturn. No matter what markets are doing, institutional investors seem to say that retail always gets it wrong.

In a way, I can see why institutional investors think that retail gets it wrong. Morningstar and others calculate something called ‘investor returns’ that look at the flow money in and out of funds to see how investors are doing when you factor in their deposits and withdrawals. This compares to the ‘total return’ that a fund earns regardless of what flows are going in and out.

According to Morningstar, the investor return on the Vanguard 500 Index fund over the 10 years ending December 31st, 2014 was 5.08 percent, a full 2.47 percent less than what the fund earned. Investors pulled money out at the bottom and put money in at the top.

It dawned on me a few years ago that plenty of financial advisors use the Vanguard 500 index funds, so while investors on the whole made bad timing decisions, you can’t say that it was solely individual, or retail investors.

I just came across a study that looked at how institutional investors fare when making changes in their portfolio. In the abstract, the authors write, ‘Much like individual investors who switch mutual funds at the wrong time, institutional investors do not appear to create value from their investment decisions.’

The paper, written in 2009, looks at data exclusively from institutional investors across asset classes and finds that institutional investors chase returns the same way that retail does.

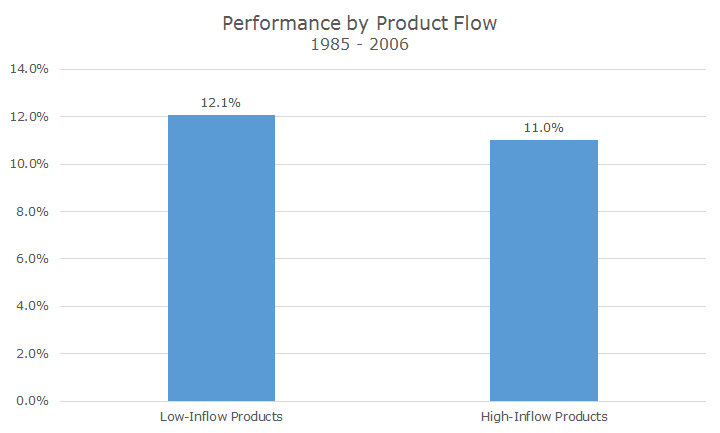

The chart below shows the returns for institutional investors one year after making a change, sorted by the fund flows.

On average, institutional investors poured money into the ‘high-inflow’ products, which are the fifth of funds that got the most assets, and earned 11 percent one year after making the shift.

The fifth of funds that had the least money flowing into them, the ‘low inflow’ products, outperformed the hot funds and earned 12.1 percent.

That wouldn’t be a big deal if it happened once in a while or even half of the time. This data shows that it happened for an entire 22 year period. Not every year, of course, but systematically enough so that the difference on average was one percent per year. Over 22 years, that difference is dramatic.

It’s understandable that institutional investors would make the same mistakes that retail investors do – after all, institutional investors are made up of people too. In theory, they have more training and experience, but I think it goes to show that all investors are subject to behavioral biases.

I’ve said for years that, on the whole, institutional investors aren’t much better than retail investors, but they have prettier Power Point presentations and more elegant explanations justifying what largely amount to the same decisions.