In the last six or seven years, a growing number of esoteric hedge fund strategies have made their way into mutual funds available to mom and pop investors like us. I’ve fussed around with a lot of these products in my own account in an effort to learn more about them and, don’t worry, you haven’t missed anything.

One of the newer offerings buys ‘catastrophe bonds,’ or cat bonds, and their related event-risk-linked brethren that serve as the risk transfer mechanism from insurance companies to investors through what is called reinsurance.

In a sense, reinsurance is insurance for insurance companies. A normal insurance company might be able to insure 100,000 in Florida and have a good system for pricing the normal everyday damage that occurs across their portfolio of insured homes, but they also face the idiosyncratic risk, or catastrophe) of a hurricane affecting 25 percent of their insured properties that would adversely affect the company.

To mitigate that risk, the insurance company can sell the specific catastrophe risk to investors in the form of bonds (and other structures) that usually have maturities of three years. The insurance company pays the bond holder a coupon and if there is no catastrophe, the bond holder gets their principle back.

Of course, if a Katrina or Sandy comes rolling through, then the bond holder loses some of the principal that they would have received if nothing had happened. Hence, a cat bond investor profits from tranquility when no catastrophe occurs.

In theory, as long as the bond is insured across a lot of regions like Florida, the Jersey shore, New Orleans, the San Andrea or New Madrid fault (not to mention places outside of the US), then one single catastrophe might not be so, ahem, catastrophic for the cat bond holders.

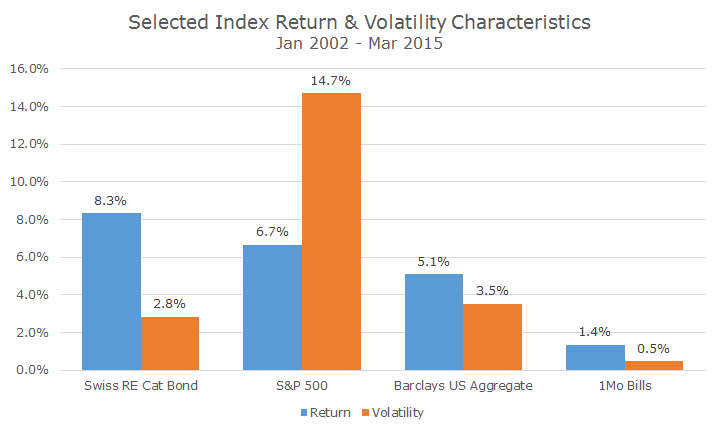

If you’re wondering why this is appealing, look at this total return chart for the Swiss RE Catastrophe Bond index:

Wow, those are amazing numbers! Granted, it’s a short time period, but it does include the 2008 financial crisis, a horrible yield environment and a number of natural disasters.

The returns are better than stocks, the volatility is substantially less than bonds and, while you can’t see it, the correlations are exceptionally low. In short, it’s an investor’s dream.

So given these numbers, how come I’m not falling all over myself about the mutual fund that invests in cat bonds?

In addition to the short track record of this non-investible index, the low volatility hides masks the risk imbedded in the fund.

First, cat bonds face a special kind of risk known as a credit cliff. There’s no risk, no risk, no risk and then, all of a sudden, BLAM, there’s a major triggering event that hits the fund in an adverse way. It’s like the ‘insane button’ on a Tesla – you can go from no losses to substantial losses in no time flat.

Second, the cat bond market is small so the bonds are illiquid. Many of the other funds invest in other securities that act like cat bonds but are even less liquid.

They say that liquidity is like oxygen: you don’t ever think about it until you don’t have it and then it’s instantly debilitating. Even if you can hold out, your fellow investors might get itchy and start selling, causing prices to fall below their true value (a buying opportunity, I know, but tough to live through anyway).

There’s a third problem that we don’t often see called ‘selection bias.’ The mutual fund managers that buy cat bonds only get to choose from the issues that the insurance company is selling. Do you think that the insurance company wants to sell the good stuff or the not so good stuff? Remember, they get to keep what they don’t sell.

There are other risks too, but it gets fairly technical pretty quickly. I can certainly see the appeal of cat bonds, but for the foreseeable future, it’s hard to imagine allocating any of your money to them.