It’s going to be a short Daily Insights today because I went to an event last night featuring nationally known financial analyst James Grant of Grant’s Interest Rate Observer and Chris Varvares of St. Louis based Macro Economic Advisors.

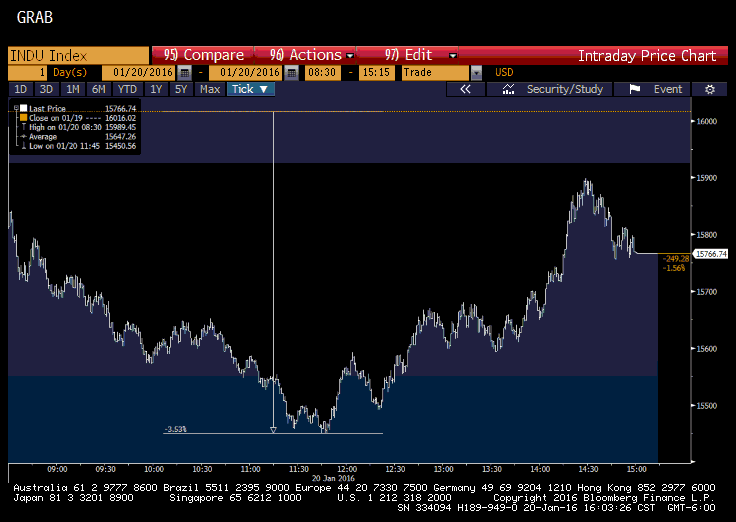

Mostly, I just have a snapshot of the intraday trading for the Dow Jones Industrial Average (DJIA). Although the S&P 500 is still my favorite measure for how stocks fared, I know most readers follow the DJIA.

The numbers are hard to read, but you can see that at one point, the DJIA along with most stock indexes, was down more than three percent. At the event, I joked with a number of folks that I had sold everything in the morning, went to lunch, and didn’t come back to work.

Traders often talk about something called ‘capitulation,’ which is essentially panic selling during high volume, sharply down days. These traders want to see capitulation because they see it as a sign that all of the sellers (forced and otherwise) have washed out of the market and it signals a bottom.

While I get the concept, I can’t say that I am really a believer, because it seems so impossible to measure and too anecdotal. That said, I feel like mentioning it because I heard a lot of chatter that yesterday could have marked an end to the swift declines so far this month.

I would take it with an absolutely enormous grain of salt (perhaps even a salt mine), but it does make it a little easier to head into work again and face whatever comes our way.