When we started this business more than 13 years ago, I maintained a scrapbook of article clippings that I called “The Big Book of Broker Misdeeds.”

At the time, we were coming out of the tech wreck and there were tons of articles about how brokers steered widows and orphans into unsuitable hot technology funds during the bubble years that blew apart when they fell back to earth.

I know a lot of honest brokers that do a good job on behalf of their clients, so I stopped adding to my big book (plus it was unwieldy). We all agree that there are some bad apples out there, but my antidotes weren’t really sufficient to make broad claims.

Last week, I really was shocked by a new working paper from the business schools at the University of Chicago and University of Minnesota that found that seven percent of brokers have been disciplined for misconduct (here is a link to the paper).

In my mind, seven percent is a big number because it means that one out of 14 brokers is operating with a checkered regulatory past.

I also happen to think the seven percent number understates the problem for a few reasons:

- Not everyone gets caught. If a client doesn’t file a complaint, bad deeds are likely to go unpunished.

- A lot of complaints are settled privately without any regulatory authorities and when a firm settles with an aggrieved client, clients only get the money if they agree not to pursue regulatory claims.

- Firms often proactively ask bad apples to leave before problems go that far.

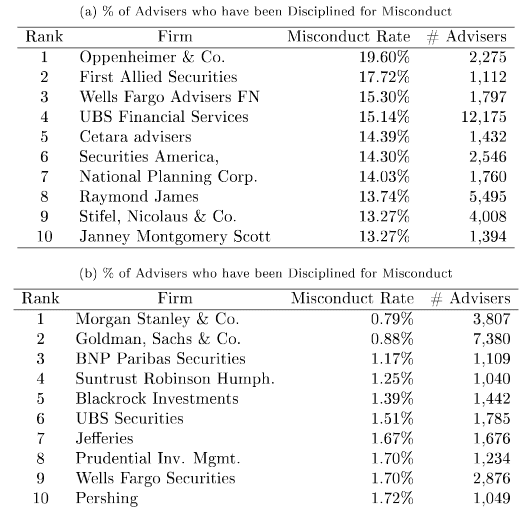

What really shocked me is some firms seem to ‘specialize in misconduct,’ to use the phrase in the paper. In the summery (I admit that I didn’t read all 60 pages), the researchers produced a table of the firms with the best and worst records:

I am astonished to see that nearly 20 percent of Oppenheimer brokers have been disciplined for misconduct. That’s one out of every five brokers within the firm. I realize that 80 percent don’t have a record, but 20 percent is huge in my book!

Before going any further, let me take a moment to defend the condemned for a minute.

I’ve seen clients who said they want risky investments and then turn on their broker when the investment goes south and claim after the fact that they never should have owned it. I’ve also seen regulators make mistakes and wrongfully discipline innocent people. I even think that there are people who make mistakes in their career, get caught, pay the price but have turned themselves around and still carry the bad marks from their past.

I also think there is merit to the ‘few bad apples’ argument. If you’ve got 12,175 brokers, as UBS does, it’s unavoidable that there will be some trouble makers that the firm is in fact trying to root out. Truly bad actors are hiding from their managers and the firm’s compliance department.

But the bad apple theory definitely doesn’t explain the fact that 15.14 percent of the brokers at UBS have a regulatory history, which comes out to an astounding 1,843 brokers!

At the other end of the spectrum, Goldman Sachs has 7,380 brokers, which isn’t nearly as many as UBS, but only 0.88 percent of their reps have a disciplinary past, which works out to 65 people. This seems reasonable for a firm the size of Goldman Sachs given the exceptions that I mentioned above.

Of course, it’s even better if none of your employees have a regulatory record like Acropolis, but I think that it’s easier to keep clean at a little shop, especially when everyone from the President to the summer intern sit in the same room like we do.

I’m sad that there is so much bad behavior out there because it sullies the reputation of the whole industry.

We’ve done our best to differentiate ourselves by forming as a Registered Investment Advisor, serving clients as a fiduciary, having mock audits and going the extra mile and getting the CEFEX-certification that makes sure that we’re doing what we say we do (more details on CEFEX here).

But when everyone uses terms like ‘financial advisor’ or ‘wealth manager,’ it’s hard for people outside the industry to know the difference between brokers and advisors. It’s one of my long-standing pet peeves, like the difference between ‘fee-only’ and ‘fee-based,’ but I’ll save that for another day.

Thankfully, I do believe that our clients can tell the difference and we’ll keep serving our clients with their best interests at heart because it’s the right thing to do.