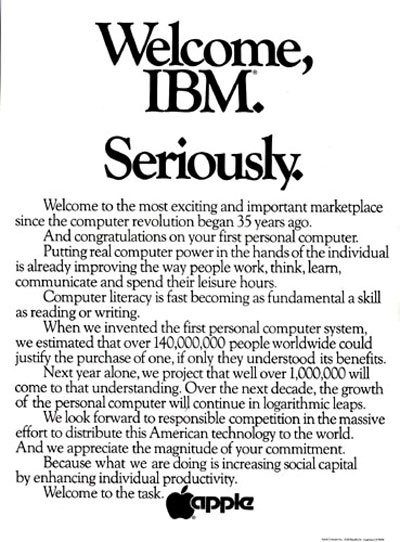

In 1981, IBM unveiled their first personal computer and in response, Apple, who had created their first personal computer in 1977 and mass produced a second version the next year, published an ad in the Wall Street Journal welcoming Big Blue to the personal computer business with the headline, ‘Welcome, IBM. Seriously.’

IBM had previously scoffed at computers for the masses and was the undisputed king of corporate computing at that time. When IBM joined Apple in the personal computing market, Apple said that they were looking forward to responsible competition in the most exciting era of the digital age.

Yesterday, the Department of Labor (DOL) introduced new regulations that will require broker-dealers, the industry term for stock brokerage firms and their registered representatives, or what I will call brokers for short from here on out.

The new regulation, known as the fiduciary rule, require that brokers put client interests ahead of their own for retirement accounts such as IRAs and 401ks. Brokers already had a suitability rule, but that isn’t as strong as a fiduciary standard.

For example, a broker could sell someone an S&P 500 fund with a 1.56 percent expense ratio as long as it was suitable for the investor to own large cap stocks (yes, I’m looking at you, Rydex S&P 500 Index Fund C-Class, ticker RYSPX).

While this exposure is suitable for nearly all investors with a long-term time horizon, it would be impossible to say that this fund is in the client’s best interest since the fee is a serious drag on performance and there are plenty of cheaper alternatives with identical investment objectives.

Under the fiduciary, standard, it would never be appropriate to recommend this fund since it is clearly not in the client’s best interests. A broker has a financial incentive to recommend this fund to a client, which creates a potential conflict of interest by putting their own interest in front of the client.

When we first started Acropolis back in 2002, we formed as a Registered Investment Advisor (RIA), which means that we serve all clients as a fiduciary all the time.

In 2009, we decided to take it a step further and become independently certified by the Centre for Fiduciary Excellence (CEFEX) to make sure that we were following all of the industry’s best practices in this regard (click here for our certificate and here for me complaining out how much work it is to maintain).

Because of our long-standing commitment to serving clients as a fiduciary, we aren’t expecting material changes in the way we do things. Since this a huge rule change, I do think that we will have to make small adjustments here and there, but that’s just part of life in a heavily regulated industry.

Now, just like Apple welcomed IBM to personal computing, we’d like to welcome all of the brokers that are going to have to change their business practices to meet the new rules.

Selfishly, I liked it the old way because I thought our business model had an innate competitive advantage over brokerage firms, but on the whole, I am happy the investors will be served as they should be, with their interests first.