One of my favorite reads of the year is from the Yale Investments Office, which manages their $25.6 billion endowment. You can find the report by clicking here.

Yale is routinely the best-performing endowment in the world and has earned a remarkable 13.9 percent return over the last 30 years – well above the 10.7 percent return for US stocks, 8.7 percent return for foreign stocks and 7.1 percent return for bonds.

I’ve read both books by David Swenson, their pioneering investment manager, and pay close attention to their annual report. I haven’t finished this one yet, but I was surprised by their large increase to foreign stocks in recent years.

Domestic stocks, in blue, have fallen steadily from over 20 percent to a measly 3.9 percent last year. Foreign stocks, in orange, have consistently fallen between 10-15 percent of their portfolio, but have risen sharply since 2012.

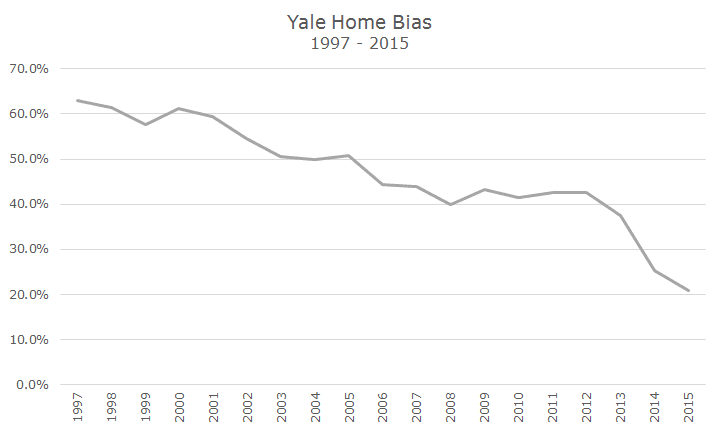

The ratio of US to foreign stocks is often referred to as ‘home bias’ since most investors, regardless of their country of origin, tend to allocate more to their home country than the rest of the world.

Right now, publicly traded stocks domiciled in the US represent about 52.5 percent of the global allocation. That number has shifted over the years, but is reasonably consistent. The chart below shows Yale’s home bias and you can see that it was fairly steady during the 2000s and has been cut dramatically since 2012 (you might say they have a foreign bias at this point).

They disclose their rationale in the report, but they do publish their return estimates for the US stocks, developed and emerging markets. They also break out the current split between developed and emerging markets, which is 5.5 percent developed and 9.0 percent emerging.

Yale is allocating more than twice as much of their money to emerging market stocks as they are to the US, even though the US is more than five time larger than all of the emerging markets combined.

Currently, they estimate that US markets will deliver a 6.0 percent real (after inflation) return with a volatility of 18 percent (for a Sharpe ratio of 0.33).

To my surprise, they have the same return and volatility estimates for foreign developed markets. Although we do expect US and developed market returns to be roughly equal over the long run, foreign markets are so much cheaper than US markets, I would have thought that they might assign higher expected returns to developed markets.

They do expect higher returns from emerging markets of 7.5 percent with a standard deviation of 23 percent (for a Sharpe ratio of 0.33). That helps explain their large allocation to emerging markets, but theirs seems awfully high given the relatively small difference in return (and no difference in risk-adjusted return).

Given their return expectations, I would have expected something closer to the natural market weight, although I would assume that their outsized allocation to emerging markets has something to do with the low correlation of emerging markets to their other asset classes. They don’t post their correlation estimates, but that’s my best guess.

Holding international and emerging stocks has been difficult over the past few years given their weak relative returns. I’m of the view that it pays to have foreign exposure over the long run, but periods like this make it tough.

I like the relatively attractive valuations overseas and even though I shouldn’t care what other investors are doing, I do take heart that Yale is making such a big bet on non-US stocks.