Spring has finally arrived, which means baseball is back. Here in St Louis, conversations always tends to lead back to our beloved Cardinals and speculation about how they will perform this year. Any discussion about the Cardinals these days also involves speculation about our friendly rivals up north, the Chicago Cubs. Despite a history of futility, fans of the small bears are always optimistic this time of year, and that is especially true this year. The Cubs have a great young team and most prognosticators are picking them to win it all for the first time since 1908. However, every season brings unexpected twists and turns that usually leave the favored team without a trophy at the end of the year. Over the past 10 years, only one preseason favorite has gone on to win the World Series. There are no sure bets in April as the factors that determine success are too complex for any model or gut instinct to accurately predict. While sports teams and financial markets are not the same, they can be equally perilous to those trying to predict their performance.

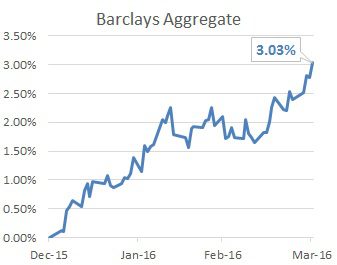

In the first quarter of 2016, financial markets laughed in the face of forecasters and prognosticators. In December, the Federal Reserve raised its overnight Fed Funds rate for the first time since 2006. This was supposed to be the beginning of the long unwind of extraordinary monetary stimulus and 2016 would put the Fed on course to normalization of interest rates. The collective wisdom of market forecasters was that the next few years would be very difficult for bonds as interest rates increased. Instead, the broad investment grade bond market, as measured by the Barclays Aggregate Index, provided a total return of 3.03% for the first quarter. The benchmark 10yr Treasury bond’s yield fell by more than 50 bps.

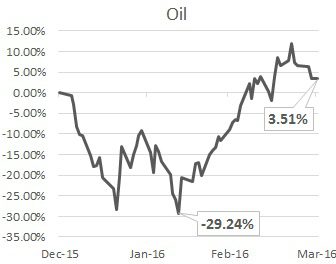

Poor forecasting was not limited to the bond market. In fact, it was worse in riskier markets. Global stock markets fell precipitously in January despite bullish sentiment to finish 2015. The S&P 500 index bottomed at -10% in mid-February. Oil had an even worse start to the year, with its price falling 30% in the first few weeks. While these markets were falling, many forecasters changed their tune and became bearish after a horrendous January. As illustrated in the nearby chart, both equities and oil sustained big rallies in the second half of February and March to end with positive returns for the quarter, proving the trend followers to be wrong a second time.

This past quarter illustrates the impossible task that is forecasting. Markets are influenced by so many factors that there is no way to predict the inputs, let alone the outcome. Take GDP for example. Every economist is trying to understand and predict GDP growth, as economic growth is the ultimate engine for creating wealth. It takes the Bureau of Economic Analysis three months to calculate GDP, so official growth figures are always a quarter delayed. Many firms, including now two Federal Reserve Banks, attempt to calculate GDP in real time. These models process data as it comes out and calculates the expected impact on current quarter GDP. This seems like it should be a fairly simple and accurate process, however each model often predicts drastically different results. For Q1 2016, the Federal Reserve Bank of Atlanta’s GDPNow model is predicting GDP growth at an annualized rate of 0.1%, whereas the Federal Reserve Bank of New York’s model is predicting an annualized growth rate of 1.1%. With an indicator such as GDP, 1% is a huge discrepancy, especially when they are looking at the exact same data! If one of the oldest, most watched and readily available indicators cannot be predicted, how can one expect to accurately price a security that is influenced by this factor along with a host of other factors?

Even if we assume an investor could accurately predict all of the macro factors that influence markets, they would struggle to predict how the market will react. If you put 10 investors in a room, you may receive 12 opinions about the same piece of data. Ronald Reagan used to say that if the game Trivial Pursuit was designed by economists, it would have 100 questions and 3,000 answers.

Even if we assume an investor could accurately predict all of the macro factors that influence markets, they would struggle to predict how the market will react. If you put 10 investors in a room, you may receive 12 opinions about the same piece of data. Ronald Reagan used to say that if the game Trivial Pursuit was designed by economists, it would have 100 questions and 3,000 answers.

The market is where these investors will go with their beliefs and biases and vote with their dollars about how they view the new data effecting the value of a security. It is not a binary outcome, where if X happens then Y is the result. Many forecasters will talk that way, but it oversimplifies how securities are priced. Markets are processing all new information in real time and assessing what it means for the economy, industries, and even individual companies. Throw liquidity and cash flow needs of investors and issuers into the mix and determining the equilibrium price of supply and demand for a given security or interest rate becomes futile.

Investing based strictly on forecasts or predictions is speculation. Rather than speculating, we advise our clients to focus on risk. Control the amount of risk in the portfolio and overweight those risks that have historically provided more return. For stocks, that means overweighting exposures to premiums such as value, size, profitability and momentum. For bonds, it means focusing on relative value strategies that are based on spreads and the shape of the yield curve. These are all strategies that have proven to add value to a portfolio over time without having to correctly predict when to buy or sell.