One of the big concerns coming out of the financial crisis was runaway inflation. Central banks around the world were buying bonds on a massive scale, which is effectively equal to printing money.

In 2010, a group of highly respected economists and investors, including Cliff Asness, Richard Bove, Niall Ferguson, James Grant and John Taylor, wrote an open letter to then Fed Chair Ben Bernanke, arguing against more quantitative easing increased the risk of inflation and currency debasement (click here to see the letter).

Nearly six years later, it’s fair to say that inflation hasn’t yet materialized and the dollar is still relatively strong. That’s not to say that the letter writers were wrong – they only said that the program increased the risk of inflation and dollar debasement, not that it was a certain outcome. Personally, I thought their case was compelling at the time.

Around that same time, Vanguard wrote several articles saying that they didn’t think that high inflation was on the horizon because the economy was growing too slowly, and, more importantly, there was no wage growth, which they saw as a ‘canary in the coal mine’ for high prices in the aggregate.

With that background in mind, my interest was piqued last week when the US Census released their 2015 Survey of Annual Social and Economic Supplements (ASEC) report, which showed that median incomes rose 5.2 percent in 2015, adjusted for inflation.

I’m not saying that inflation is here or even right around the corner, but I do think it’s worth noting that one of the conditions that’s been missing since the crisis that can create inflation may be something to pay attention to again.

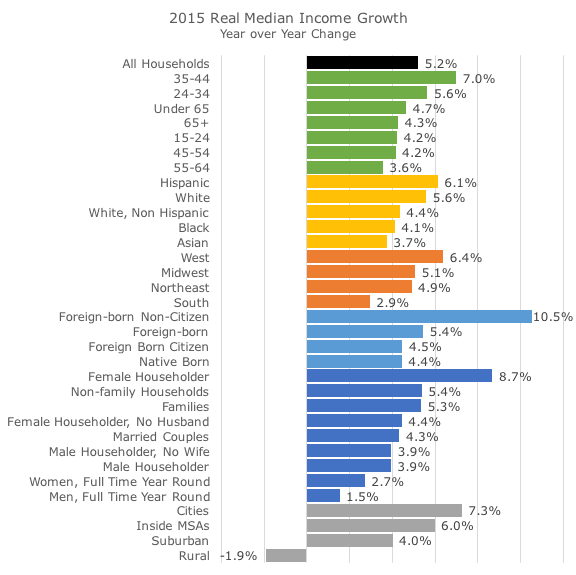

The chart below doesn’t offer any particular clues about inflation (except that the gains were relatively broad based), but I thought that it was interesting to see the income growth data broken down into various demographics.

I tried to make the color-coding relatively obvious: age brackets in green, racial/ethnic in yellow, region in orange, citizenship in light blue, gender/household in dark blue and population density in gray (MSA is a metropolitan statistical area).

With the exception of rural workers and men working full time year round (hey, that’s me!), median wages outpaced inflation. We’re still 2.5 percent below the 2007 peak, but another year like 2015 would more than do the trick.

In my view the report is almost unambiguously good and the increase in real income growth should lead to more consumer spending, which is the largest component of gross domestic product (GDP).

As I said above, I don’t think this one report is enough to create much concern about inflation, but it’s on my radar in a way that it hasn’t been since the first few years coming out of the financial crisis.