I feel as though I’ve written this article a few too many times: value investing is struggling.

Pioneered by Warren Buffett’s mentor Benjamin Graham, value investing is the method of buying stocks inexpensively, with the hope that the current problems that’s causing the cheapness pass, and the stock will rebound sharply.

Decades into Buffett’s illustrious career, finance academics found that the process of buying cheap stocks led to higher than average returns. They also found that buying expensive stocks lead to lower than average returns.

The most common dataset used to track value is courtesy of Ken French, who maintains extensive data on his Dartmouth website, which can be found here (although, like a lot of academics, he makes it difficult to understand and use).

To evaluate value investing, French creates a long/short portfolio that buys cheap stocks (long) and sells expensive stocks (shorts). The idea is that you are isolating the effect of cheap and expensive stocks by eliminating the broad market movements.

The following chart shows the 30-year growth of $1 invested in a long/short portfolio of value stocks in the US, across the developed markets (the World) and the World, excluding the US.

You can see that over the past 30 years that value has worked the world over, but that in this particular period, it’s worked much better outside of the US than it has at home.

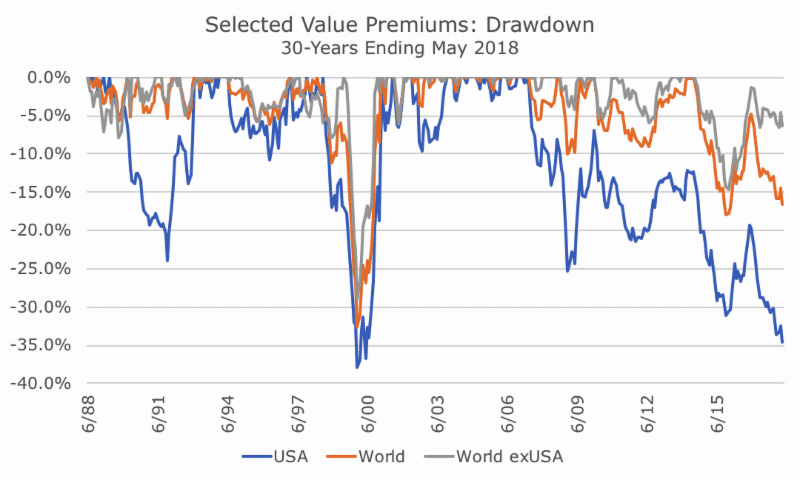

Although you can see that value in the US hasn’t done much since 2006 or so, the chart above downplays how bad it’s actually been here. The following chart, which shows the drawdowns for each index above tells a much more dramatic story. For a quick primer on drawdowns, click here.

Ouch, this is a much tougher representation of the same thing. Focusing just on the US, you can see that we are well into the third drawdown in 30-years, and it’s much longer than the other two and the second deepest.

From the peak just before the 2008 financial crisis, the long/short portfolio is down 30 percent (this data ends in May, and value has continued to lose ground versus growth).

Okay, now for the tough questions. Why is this happening? How bad will it get? How long will this last? When will it turn around? What will cause it to turn around? Will it ever turn around? Should we throw in the towel?

Each one of these questions deserves a lot of time and attention, but I’m only going to give each one a paragraph or so. Why? Spoiler alert: no one really knows any of the answers.

Why is value suffering? No one is sure, but it does resonate with me that the turning point is the 2008 financial crisis. Typically, value stocks suffer going into recessions and come out stronger than others. That happened in the US, but instead of continuing to fare well, value stocks fell out of bed a second time in 2010 and never came back and started falling again.

Could it be that the easy money policies of the Federal Reserve is causing money to be misallocated? That’s an argument that I’ve heard for a decade and while I don’t know why it would apply to value stocks in particular, it’s possible.

Also, keep in mind that in the long/short construction, you don’t just consider the stocks that you own (or are long), but the stocks that you’re short. In this case, the charts above are short the hottest stocks of all time: Amazon, Netflix, Tesla, etc.

Being ‘short’ these stocks is a tremendous drag on returns. You can see the same thing in the 2000 tech bubble and wreck, but this one is going a lot longer (thanks to the Fed?).

Question number two: how bad will it get? No one knows. You can see that it’s almost as bad as it’s ever been, but things can always get worse (also, this is a short data set, I didn’t go back all the way to the 1920s).

It’s like asking, how high could Netflix go? Well, I never would have guessed this high, so going up another third is both inconceivable and believable at the same time.

How long could it go on? The answer is the same as the last one, for the same reason. Could Netflix be higher one year from now? Sure. Four years from now? I wouldn’t think so, but I thought that four years ago.

What will cause it to turn around? At some point, I believe that the value effect will come back into favor. At some point, people won’t be willing to pay any price for growth and will seek out companies that are cheap. At what point is that? I have no idea. At some point…

A few years ago, when small caps were suffering for years on end (and it felt like an eternity), people would ask me what might cause small caps to turn around. I had no great answer.

Now, after the fact, I know that it was the 2016 election that brought Donald Trump into the White House. Trump, along with the already Republican Congress, created tax cuts that benefitted companies, especially smaller, more domestic companies that weren’t already benefitting from global tax arbitrage.

Will value ever turn around? As noted above, I think it will, even though I am beyond hazy on the timing. Some people, however, are legitimately asking whether value investing is dead and may never come back.

A large group of investors make the case that all of the focus on smart beta indexing has killed the premium. I think that there’s an argument there, but not a great one since value was practiced by managers like Buffett for decades.

Should we throw in the towel? I don’t think so. Since I take the view that value investing isn’t dead and will turn around, I don’t want to miss the upside. Like the overall stock market, I think it’s a mistake to hold onto all of the risk of the downside, sell out when it feels the worst and miss out on the upside.

I feel like we’ve made it this far, let’s stick with the program and benefit when the strategy comes back. I am thankful that we’ve paired value with quality, momentum and size, which are all doing relatively well.

When we added momentum a few years ago, one question was whether we should just double up on value, since the premium is about the same. We didn’t do that in favor of factor diversification – and thank goodness for that!

I also take heart that value is still working outside of the US. The current drawdown is only five percent in the rest of the world (which argues against the Fed argument, given what the Bank of Japan and European Central Bank are doing), which is nothing but noise.

One last question: Do you think Warren Buffett is wondering whether value is dead? Being competitive, he’s probably not happy that Amazon’s Jeff Bezos is now wealthier than he is, but I suspect that Buffett’s not worried about whether value is dead, so I’m not going to either.