I’ll bet you know the old Ben Franklin saying that ‘the only things certain in life are death and taxes.’

While those things are certain, there is, thankfully, much more to life. A full life will mean different things to different people, but there are probably common elements that include family, friends, good health, prosperity, spiritual wellbeing, and fun, among other things.

We also know that life can be difficult. Everyone has experienced the loss of a loved one, and as we age, health issues pop up for ourselves and the people we care about. And while things are relatively quiet here in suburban St. Louis, the war in Ukraine reminds us how hard things can be.

In other words, life is full of ups and downs.

Since this is a market newsletter, I’ll hasten to add that markets are no different.

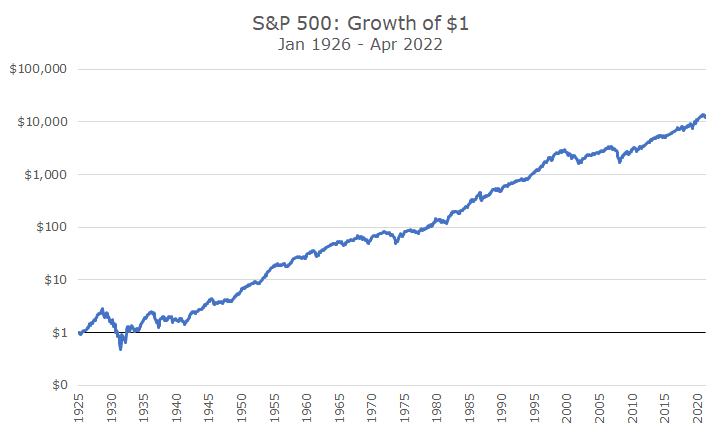

Since 1926, the S&P 500’s annualized total return has been 10.3 percent through Friday. So, we can say that on average, and over time, the stock market has grown at an attractive rate. In total, life’s been good for stock investors.

But we also know that there have been ups and downs. If we isolate the down markets and look just at the drawdowns in the chart below, it looks a little scarier because you can see that the market lost 80 percent in the Great Depression and 50 percent in the 2008 Global Financial Crisis (GFC).

You can see that the market is currently down -13 percent from its recent high, so the market correction is now official since the -10 percent drawdown occurs with monthly data.

The market spends about a third of the time (33 of the 96 years) in drawdown. The first part of the drawdown is the decline, and the second part is the recovery back to the peak. The trouble is that you don’t know how deep it will go or how long it will last at the start of a drawdown. Most of them don’t last long or run too deep, but you don’t know what the current one will look like in the end.

That’s partly why we like to expand our gaze and look at longer time frames. I think it’s fair to say that the full 96-year time span is too long – not many of us will live that long, and even if we did, we didn’t start investing on day one.

Our average client is in their 60s, so a 25-year time horizon is probably the right one, but not many of us have an attention span that long (or pain tolerance that strong). So, let’s look at five years: most of us can think in those terms.

Even with the current drawdown, and the 2018 and pandemic drawdowns, the market was up 13.6 percent annually over the last five years. That’s pretty good – about the 62nd percentile of all five-year periods.

But you can also see that there are long stretches where even the five-year rolling returns are negative or around zero. I could clean that up by extending the rolling period to 10-years, but the point that I am trying to make today is that life and markets are full of ups and downs, so I want to show the ups and downs rather than erase them.

We all know that markets go up and down – we’ve all experienced it. And, we all know that, historically, investing in stock pays off. I believe that stocks will continue to earn attractive returns in the future because stocks are ownership in businesses that earn profits that accrue to the shareholders.

If we thought we could time the markets, we would. But we’ve never seen anyone do it successfully. The most famous investors in the world didn’t: Warren Buffett, Peter Lynch, and Bill Gross were buy-and-hold investors. George Soros timed markets, but research has shown that he didn’t do well timing the market: he made his money from other sources.

As unpleasant as it is to lose money, especially with the uncertainty about how much you may or may not lose in the next one, three, five, or ten years, it’s all part of the process. A market without losses would be like a life without sadness or grief. The appeal is obvious, but it’s not reality.

I think even Ben Franklin would agree that in addition to death and taxes, we can be certain that the stock market will be volatile.