We may not be happy with the slow and choppy recovery from the 2008 financial crisis, but I think we would all agree that we can thank our lucky stars that we aren’t suffering like the Greeks.

The definition of an economic depression isn’t precise, but I think we can all agree that Greece is mired in a horrible depression: the economy is almost 30 percent smaller on an inflation adjusted basis, unemployment was 25.7 percent at the last reading and deflation is a real problem.

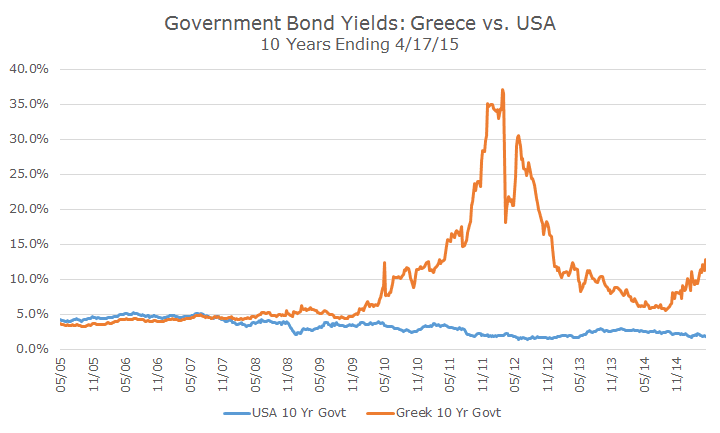

You can effectively see the timeline in problems based on the yield of the 10-year Greek government bond. Ten years ago, the yield on their 10-year government bond was lower than ours, although ours was lower by the end of 2007 as investors started to use US Treasury bonds as a safe-haven. You can see how the problem was at its peak in 2011 and calmed down to a large degree until about a year ago.

The origins of the crisis are not surprising. Even before joining the euro, Greece was living beyond its means with high government budget deficits and ran up the debt. The problem became worse after joining the euro as public spending almost doubled and tax receipts failed to grow by one-third.

Despite the proliferate spending, the Greek government reported that it was complying with the terms required by all European Union (EU) members even though that wasn’t true. When the 2008 financial crisis came, all of the hidden borrowing came to light and the international community lost faith in the Greek government’s ability to repay their debts.

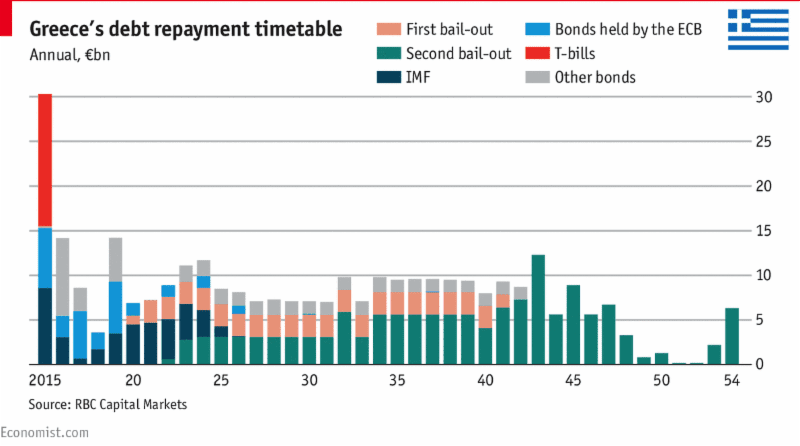

Ultimately, the International Monetary Fund (IMF) and the other members of the EU bailed out the Greeks – twice and in excess of €250 billion. Even still, private sector lenders had to write off 75 percent of the debts owed to them and were forced to accept lower interest rates on the remaining 25 percent of bonds outstanding.

Now, it’s payback time and the Greeks are struggling to make their payments, and the new Socialist government is saying that they need to renegotiate the terms of their bonds again. At this point, the government is saying that if new bail-out terms can’t be reached, they will miss interest payments equal to €2.5 billion.

Anytime that a borrower fails to make payments, they are in default, and Greece will not be an exception. The question at this point is who the Greeks won’t pay: their international creditors like the IMF and EU or their pensioners, who are also due about €2.5 billion this month.

Regardless of who doesn’t get paid, it seems likely that the Greek government will have to introduce capital controls, bank holidays and other restrictions to maintain stability in the financial system that will cost them dearly in both the short and long run.

From our perspective, what happens in Greece is not material because our exposure is tiny: Greece equals 0.10 percent of our developed international markets stock exposure and our foreign bond exposure does not include any exposure to Greece.

However, what happens in Greece may matter a lot because their problems could spark contagion in other markets. It’s impossible to say what the implications will be, but it wouldn’t be a surprise to see troubles in other developed periphery countries like Spain and Italy or in emerging markets overall.

Given that stock market valuations in the US are high, a Greek exit, or ‘Grexit’ could be the spark that finally starts a long overdue sell-off in our markets. That’s not a forecast or even a baseline assumption, but you never know what will happen next – the key is staying diversified and making sure that you’re comfortable with your asset allocation.