Value investing is perhaps the oldest and best-known investment strategy, which basically suggests that cheap stocks tend to outperform expensive ones.

The strategy was first popularized by Benjamin Graham, teacher and mentor to Warren Buffett, who also co-wrote one of the most important books in finance, Security Analysis, with David Dodd in 1934.

Graham introduced the idea that stocks have an ‘intrinsic’ value that can be roughly estimated with a fundamental analysis of a company’s financial statements.

If the market value of a company was less than the intrinsic value, Graham argued that it was a good value and that, ultimately, over time, the market price would appropriately reflect the intrinsic value in the market.

While Graham’s approach influenced legendary investors like Buffett, Phil Fisher, Walter Schloss, Peter Lynch, and others, the academic community didn’t catch on until the 1970s and early 1980s.

It wasn’t as if academics didn’t know about value investing. In fact, most old school finance professors used Security Analysis as a textbook (Columbia, where Graham also taught, still does).

It wasn’t until the 1970s that there were computers powerful enough to analyze the overall market instead of relying on a small sample of anecdotal evidence. The broad analysis supported the value concept, though, that cheap stocks tend to outperform expensive ones.

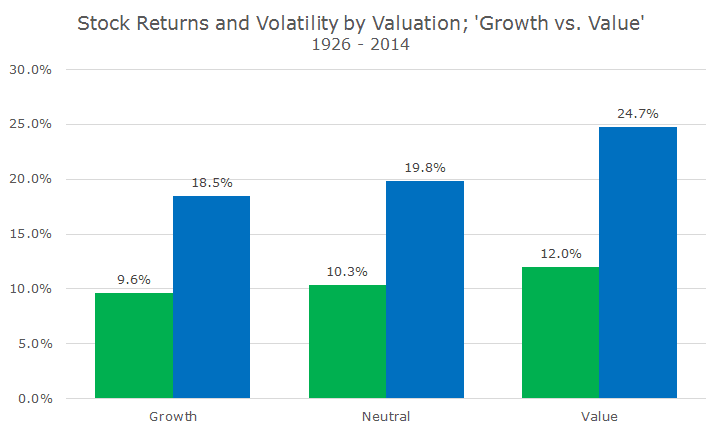

In the most famous studies, the academics split the universe of stocks into three categories, growth, value and neutral.

They apparently regret referring to expensive stocks as growth because the expensive stocks tend to underperform and, therefore, don’t offer as much growth. The idea behind the name was that investors appear willing to pay high prices for stocks that are growing quickly (think Netflix or Tesla).

It makes sense to pay more for a growing asset because the future cash flows will be higher, but if you pay too much for that growth, it won’t do you any good as an investor.

The generally accepted theory for why value works isn’t about overpaying for growth, however, it’s the idea that value stocks are cheap for a reason, that there is some problem with the company or industry.

Value stocks are in some kind of distress and investors require some form of compensation for taking the risk of owning a company that is undergoing problems.

What the academics figured out was that you didn’t have to do a lot of incredible analysis to figure out whether a stock was cheap – if you simply bought the 20 percent of companies that are the cheapest, you’ll fare as well as most value investors like Graham.

Of course, like small stocks, value stocks tend to be more volatile than the overall market, which is thought to be a manifestation for the additional risk that value stocks represent.

On average, though, the distressed companies right themselves thanks to action by company management. Some companies go under, like Borders Bookstores, but, on average, the winners more than pay for the losses.

Fortunately, the additional risk is a sign that value investing isn’t likely to stop working as an investment. It’s been 30 years since academia ‘discovered’ value investing and more than 80 years since Security Analysis was published.

But, as long as there is competition, there will always be stocks in distress, these stocks will be cheap and risky and not everyone will want to own them. That process is what has allowed a great strategy like value to endure.