As I noted last week, this year’s Investor Social is full beyond capacity, so unless you’ve already reserved a spot, I won’t see you in person tonight. Not to worry, we’re going to find a bigger venue next year and may try and figure out video for a webcast (we’ll see).

I don’t want to steal too much of my own thunder and am kind of wiped out from preparing, but I will show one more slide in advance of the show. In the coming weeks, I’ll probably use more of the slides that I think are useful.

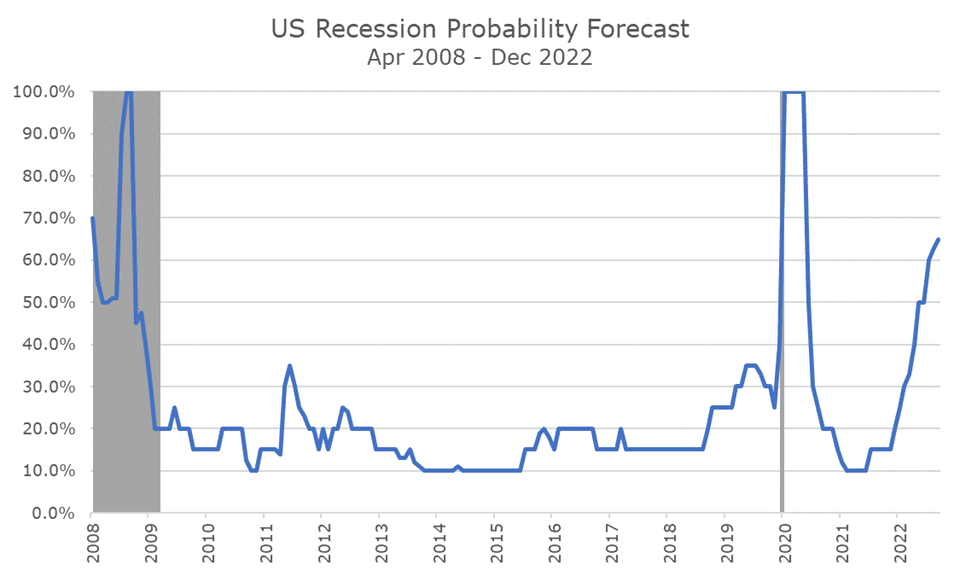

The following chart shows the results of a survey sent from Bloomberg to 60-80 economists and Wall Street prognosticators that asks, ‘what are the odds of a recession in the next 12 months?

It’s pretty clear that the economists think that the odds have gone up in the last year, from 10 percent at the start of 2021 to 65 percent now.

Before you get too bummed out, remember that these forecasters haven’t exactly knocked it out of the park.

In 2009, they forecasted a 100 percent chance of recession – but six or eight months into the recession! Once the recession pandemic ended, 100 percent said that it was coming. That one may be a little unfair because the pandemic was so far out of left field.

Even during the good years, 10-30 percent said that a recession was coming. Is that the work of some perma-bears, or is it a recognition that there’s always something lurking around that we should be worried about? I think it’s the first one, but I’ll entertain the second.

My take is that there is a pretty good chance we’ll have a recession, and that’s okay. Recessions are part of an economic lifecycle like winter is to a year. If I were to guess, I’d say that there’s a two out of three chance that there will be a recession, but I can’t say whether it will be mild or harsh.

Either way, I’ll keep holding my portfolio and won’t attempt to time anything because I know there will be a recovery after the recession, just like spring follows winter. And summer and fall after that.