It’s that time of year when another batch of kids finishes school and begins working.

Old folks like me will offer plenty of advice knowing that most of what we say will be a little lost on these fine young people, just as it was on us when we were their age. You never know, though, good counsel today might get re-tweeted and go viral.

My advice is simple: buy stocks.

When I graduated from college 20 years ago, the world was a different place: only a few people had cell phones , the Internet wasn’t useful for anything, and nobody used email or instant messaging.

, the Internet wasn’t useful for anything, and nobody used email or instant messaging.

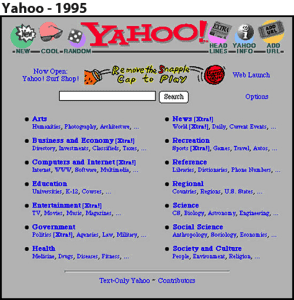

I have a few pictures from the olden days just to show how archaic it really was. My first phone was the sweet one on the left.

Notice that there were no search engines, only Yahoo’s effort to catalog the internet like a library. Do a Google search of 1995 website designs for some fun – Apple and Amazon’ s sites are particularly bad.

s sites are particularly bad.

I should note that I didn’t have to walk to school uphill both ways – that was before my time.

A lot has happened since I graduated and started participating in financial markets:

- The euro is introduced, creating a single market in Europe.

- Two of the five worst market crashes occurred, falling more than 50 percent both times.

- The September 11 terrorists attack close markets and terrify the nation.

- The 10 largest bankruptcies of all time all occur: Thornburg Mortgage, Chrysler, MF Global, Conseco, Enron, CIT Group, General Motors, WorldCom, Washington Mutual and Lehman Brothers.

- There were two recessions, one of which is the largest in US history outside of the Great Depression.

- The first inflation-protected bonds are introduced in the U.S.

- The US enters into two wars: Iraq and Afghanistan.

- The government took Fannie Mae and Freddie Mac into conservatorship.

- The yield on the 10-year Treasury note fell from 7.05 percent to 2.15 percent.

- The Federal government shut down three times.

This is just a partial, off the cuff list of 10 things that I could think of – it’s far from a complete list of major events. If you think of a good one, be sure to let me know.

What I find amazing about this list is that while these events took place, the S&P 500 grew at an annual rate of 9.3 percent. Obviously it wasn’t a straight line upwards, but the annualized volatility was actually a little less than the long-term historical average.

I decided to see if the returns for the S&P 500 over the last 20 years were statistically significant compared to returns on one-year Treasury bills. Indeed, I can say with 97 percent confidence that the returns were higher, although it was interesting because we didn’t cross the ‘significant’ threshold until about two years ago.

The ‘significant’ story is partly a function of looking at the S&P 500. I didn’t test all indexes or a balanced portfolio, but I did look at returns for the rest of the developed world in dollar terms and because they only earned 5.2 percent, they weren’t statistically different than cash.

But, who’s to say what the next 20 years will look like? Right now, non-US stocks look a lot cheaper than our markets, so it’s not hard to think that their returns will at least match ours or potentially be higher. That said, while US stocks will likely have lower returns over the next 10 years, no one can say much about the 10 years beyond that.

And what about China? Where will they be in 20 years? I read something today that if the mainland A-shares were included in the emerging market indexes, Chinese stocks would be half of the broad index. Will they even be considered emerging in 20 years or will they be considered developed markets?

The point is that we don’t really know what the future will bring. We assume that over the coming decades markets returns will roughly match past market returns, but even that’s uncertain – they could be a lot better or a fair amount worse.

The good news, though, is that stocks represent ownership interests in operating businesses and as long as the system is based on capitalism and we have the rule of law, stocks should earn more than bonds or cash.

So, young grasshoppers, buy stocks and do it in a diversified, global way.