A little more than ten years ago, Greece almost left the European Union (EU) because the longstanding structural weaknesses of the Greek economy were hit hard by the 2008 global financial crisis. The crisis was called Grexit, which should sound familiar since it was adapted a few years later for the Brit’s departure from the EU.

Greece wasn’t alone, though. Several EU countries were in trouble: Portugal, Italy, Ireland, and Spain. Together with Greece, they were known as the PIIGS. It was fitting not just as an acronym but also since the countries in question routinely spent more than they made, leading to financial imbalances.

At the time, there was a lot of discussion about Credit Default Swaps, or CDS, that act like insurance on government debt. CDS are complicated derivatives, but the idea is relatively simple: two parties enter into a contract where one party pays a premium to the other and, in exchange, receives protection from the other party in the event of a default.

Let’s say I own a bond issued by ABC Corporation, and I’m worried they might default. One avenue to deal with that risk is to enter into a CDS with someone else where I pay them a premium, and if ABC defaults, they’ll pay me what I lost in the default.

Of course, if it’s evident to everyone that ABC will default, the CDS will get expensive. It’s like me trying to get life insurance, and I walk into the life insurer’s office with many terrible diseases – they may issue me a policy, but it will be costly.

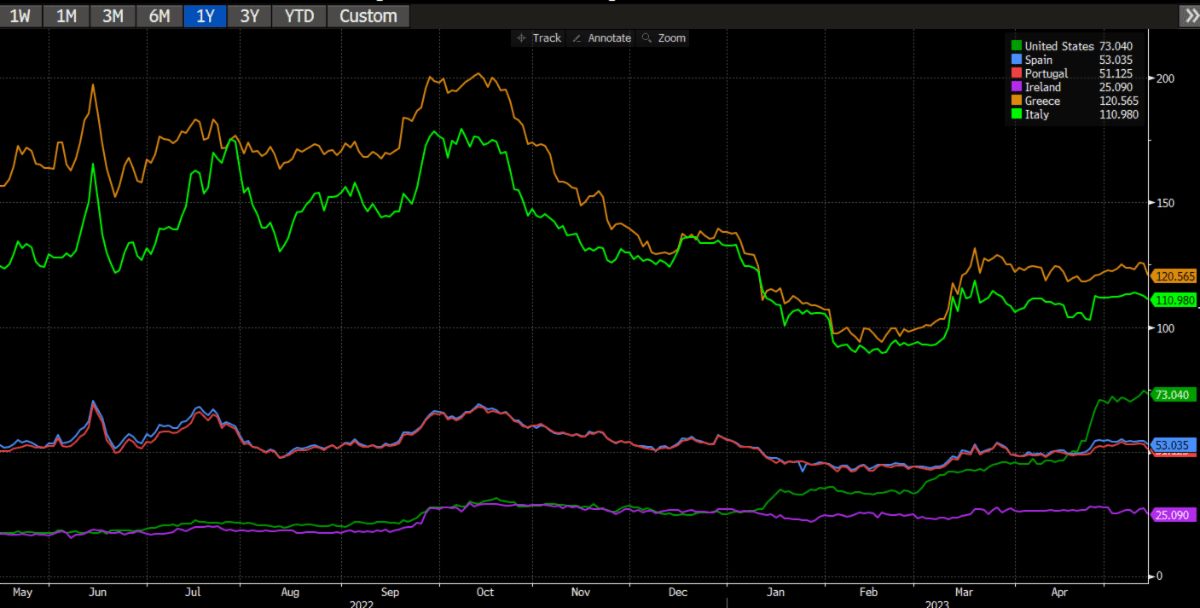

As our elected officials fight the debt ceiling, the cost to insure our government bonds from default rises. This screenshot from my Bloomberg terminal is a little hard to read – I couldn’t download it as usual and make it easy to read, but hopefully, you can see the critical part.

Here’s the point: A year ago, the cost to insure our government bonds was about the same as in Ireland, and every other PIIGS was more expensive. Starting in January, the cost to insure our debt began to rise as investors started to get nervous about a possible default.

In April, the cost to insure our debt became more expensive than Spain and Portugal in addition to Ireland. Only Greece and Italy still cost more, but it will only be a few months at the pace we’re going.

That’s the bad news. The good news, or the less bad news, is that these levels are low. Ten years ago, the cost to insure the PIIGS outside of Greece was 10-12 times more than it is now (Greece was 165 times).

In other words, markets are more worried about a debt default in the US than a few months ago, but not at all like they were 10-12 years ago.

I should add there are issues related to the CDS market that I don’t fully understand. At the very least, it’s illiquid, so prices may not be perfect.

Still, I hope that my reading is correct and that the risk of default is higher but still low. Standard & Poor’s downgraded US debt from AAA to AA in the last decade because of a debt ceiling showdown.

It makes sense that we must do something about our debt situation, but this hardly seems right, regardless of your political party.