Earlier this year, when Congress seemed to come together and avoid a debt ceiling crisis, I listened to a podcast that said we would right back to the same problem in the fall. I didn’t pay much attention because I was annoyed with the government and the fall was months away.

Although I am loving the cooler weather, I’m annoyed again because the deadline to deal avoid a government shutdown is at the end of this month, less than two weeks away. I’m skimming more articles about what may happen, and assume, like always, that nothing will happen until the very last second.

At the beginning of last month, one of the big three credit agencies, Fitch, downgraded the US credit rating from AAA to AA+. They said that they were unhappy about the large and increasing deficits and the political dysfunction that they observed.

It was a little bit of déjà vu all over again because that’s what S&P said when they downgraded the US credit rating in 2011. Perhaps that’s why the bond market yawned at the news: it’s been more than a dozen years since the larger, better-known agency said the same thing and nothing has really changed (other than loads more debt).

Last week, a client called and asked whether his Treasury bills that mature in October and November would be paid. I told him that in my heart of hearts, I thought there was nothing to worry about.

I’m often surprised by the decisions our government makes, but I’m not worried about this one – like Winston Churchill (apparently) said, “Americans can be counted on to do the right thing, after they’ve tried all of the alternatives.”

So, I’m not worried about the short run, but I can’t help but wonder about the long run – will our extraordinary deficits, debts and political disfunction be a problem? At some point, for sure, but it could easily be decades away.

When Fitch made their announcement, I was reminded that I saw General Motors credit rating history back in the 2008 Global Financial Crisis (GFC). I was shocked that a company about to go bankrupt once had a AAA rating. Those days were before my time.

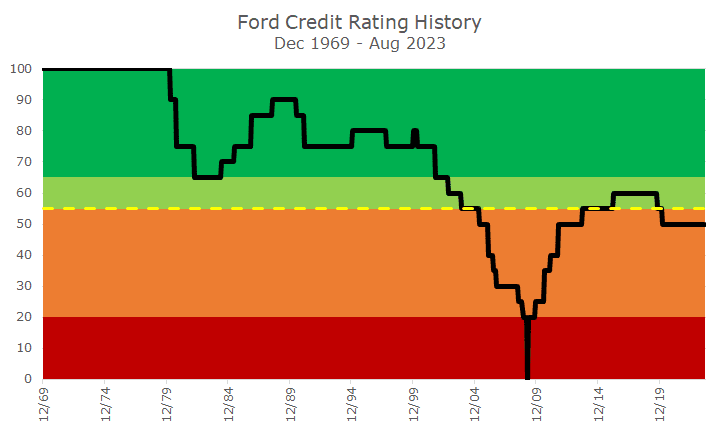

The chart below shows the credit rating history for Ford. I couldn’t pull GM’s because the company that exists today isn’t the one that defaulted on their bonds. Wikipedia has a brilliant entry on their Chapter 11 reorganization, which you can find here.

I suspect that Fords looks similar, but they pulled themselves out of the morass without having to reorganize. The chart below shows their history, but to make a chart, I had to convert ratings into a number.

A triple-A rating has a score of 100, and you can see for the first 10 years of this period, Ford carried an AAA rating. The other numbers in dark green are various degrees of an A rating, from AAA at the top to single-A minus at the bottom. The light green reflects the three BBB ratings: plus, neutral and minus.

The yellow dotted line marks the difference between investment grade bonds and what are euphemistically called ‘high yield’ bonds, or non-investment grade (or junk bonds).

The light red reflects the other B ratings from BB+ to B-. And the dark red are the C ratings. There is one D-rating and that stands for default. There are no good defaults, so there aren’t a lot of gradations.

I don’t know the history of Ford, and this certainly isn’t meant to malign them, I just used them because GM was gone (not the brand, but the company that defaulted), and General Electric was too complicated and weird.

In any case, all three of them are storied American brands that once represented the pinnacle of American business but got into trouble over the long run. The metaphor works regardless of the company.

Without doing any substantiative analysis, but looking at that chart while thinking about America, I’d say that it will be decades before we run into a real problem. And we won’t learn about it from S&P, Moody’s or Fitch: our bond prices will reflect the risk.

I hate the idea that we wouldn’t be investment grade like Argentina, Turkey and Pakistan (or default like Russia). But I don’t even want to get to single-A like Japan, China or Spain.

Maybe I’m too optimistic, but I don’t think it will happen, even when my kids are old. I think Churchill was right, we’ll do the right thing after trying everything else first.