A correction is defined as a 10 percent peak-to-trough decline and a bear market is defined as a 20 percent peak-to-trough decline.

With those definitions in mind, it’s worth noting that the utilities sector entered correction territory yesterday after falling 10 percent from their highs at the end of January.

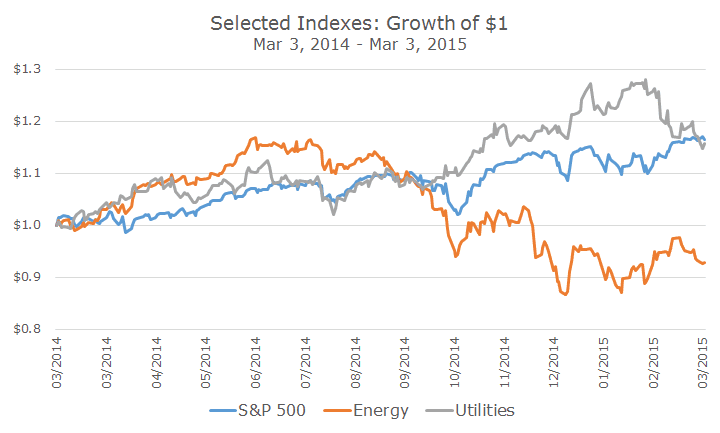

Energy stocks are down more than 20 percent since their high last summer, and have been in bear market territory since the end of last year (to no one’s surprise at this point).

As you can see from the chart above, the fall in utilities has been relatively recent. Utilities are very sensitive to changes in interest rates and, as noted above, rates are higher in recent weeks causing utilities stocks to fall.

I don’t mention the correction in utilities or bear market in energy stocks as earlier indicators or ‘canaries in the coal mine’ – to the contrary, this kind of thing happens all of the time, but most people don’t notice because the S&P 500 itself is well diversified.

There are ten sectors in the S&P 500 and the highest correlation is between Consumer Discretionary stocks and Industrial stocks. Utilities have the lowest correlation to other stocks across the board, and the lowest correlation between any two sectors are Utilities and Technology stocks (no surprise when you hear it).

We actually don’t have any utilities on our Approved List – we used to, so some clients may still have them, but they tend to have the lowest returns over time, are too highly correlated with bonds and are a very small segment of the S&P 500 with a 3.4 percent weight, making it hard to diversify within the sector.

Of course, we recommend diversifying well beyond the S&P 500, but it is nice to know that the large cap index itself is well diversified. That’s true of the other asset classes that we use in the US and overseas (although to a much lesser extent in emerging markets, where financials are a disproportionately large sector weight).

As I’ve said before, there’s good diversification and bad diversification and you needn’t worry about the correction in utilities or the bear market in energy stocks because the S&P 500 is well diversified and those losses have thus far been offset by gains in other sectors.