Last week, I wrote that it was difficult to find ‘alternative’ investments that were truly diversifying and that, as a whole, alternatives provide basic broad market exposures that you can find less expensively elsewhere. Click here to refresh your memory.

A client wrote in after that email to ask if we would ever consider gold. I wrote about gold a little more than a year ago (twice because it’s such a big topic) and the reader response was surprisingly voluminous and passionate!

At the center of my thesis against gold is that it doesn’t have any real investment value since it doesn’t follow the basic formula of finance that an asset’s present value is equal to its future cash flows at some appropriate discount rate.

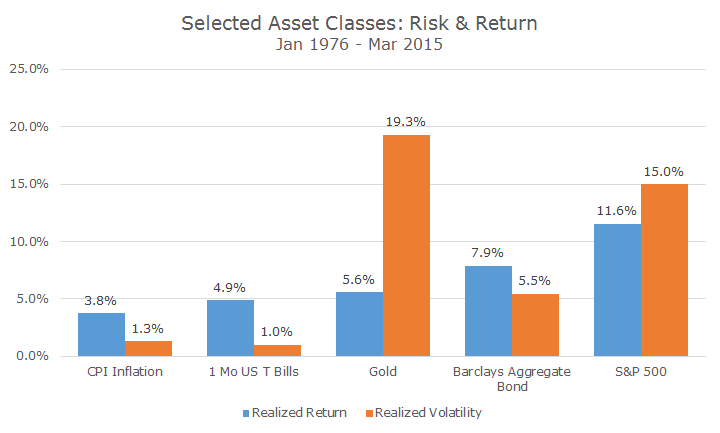

Since gold has no cash flows other than when you sell it, you wouldn’t expect gold to grow at a rate above inflation. On average, that’s been true, but the volatility is massive: more than stocks since 1976, shortly after the gold standard was abandoned.

If you want to hedge against inflation, there are much better choices like inflation-protected bonds or even one-month US Treasury bills.

The chart below shows the return of various instruments along with their realized volatility and with gold, you get less than bond-like returns with more than stock-like volatility, another chink in gold’s 24 karat armor.

Now, before you gold bugs get too upset, I want to say that my position has softened in the last year. I can’t say that I’m a gold advocate, but I’m not opposed anymore either. And not because the returns have been good either, gold is down almost 10 percent over the last year and 30 percent over the last three years.

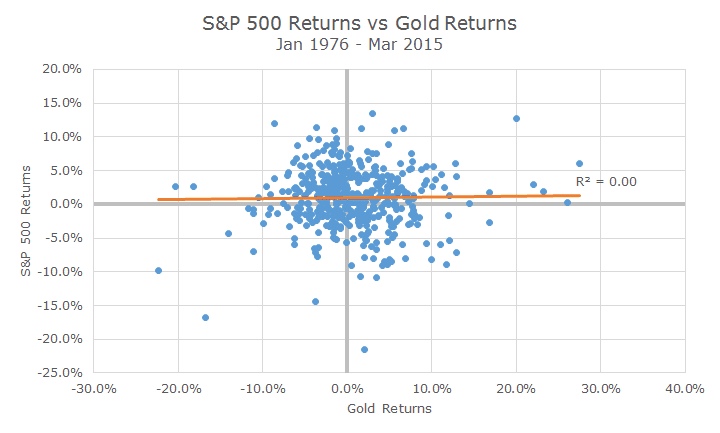

The attribute that gives gold value in a portfolio is that it’s not correlated to stocks or bonds. The chart below plots the returns of the S&P 500 on the vertical axis and the returns of gold on the horizontal axis. The orange line through the plots shows that there is no relationship at all between these two assets over this period.

From a portfolio perspective, that’s worth something because lowly correlated assets can reduce overall volatility – one asset zigs, another one zags. And, as luck would have it, stocks have gone up over the past one and three years fairly dramatically, so the relationship between the two assets continues today.

Now, before you gold bugs smugly say, ‘I told you so,’ you should keep in mind that the same thing can be said for inflation-protected bonds. I still wouldn’t make the case that gold is a perfect asset (but what is?).

Gold does act as a non-state sponsored currency, which is potentially valuable. Although I’m not a particular dollar bear, if I were a Russian holding gold over the last year, I’d be a lot happier than my neighbor holding rubles.

I don’t think you’re going to see us add gold to portfolios anytime soon, but if people ask me if they should have gold in their portfolio, I am more likely to say’ if you want it, we can add it.’ Most of the time, the people that want it only want a little bit, maybe five percent, and we can live with that, especially if there is a real diversification benefit, which I think there is.

Now, having an exchange-traded-fund (ETF) that owns gold doesn’t do much for you in a Mad Max type scenario. You won’t be able to barter with your brokerage statement, so if you think the end of the world is coming, don’t buy an ETF, fill holes in your back yard with the metal and get some guns and ammo to keep your pilfering neighbors away.