In my opinion, one of the most amazing stories this year is the surprise drop in interest rates. The 10-year US Treasury note started the year at three percent and nearly everyone, including me, expected interest rates to rise this year (but for the short end, which is controlled by the Fed).

Today, the 10-year closed at a yield of 2.40 percent and closed as low as 2.34 percent last week. At their low, the 10-year traded at 1.39 percent in

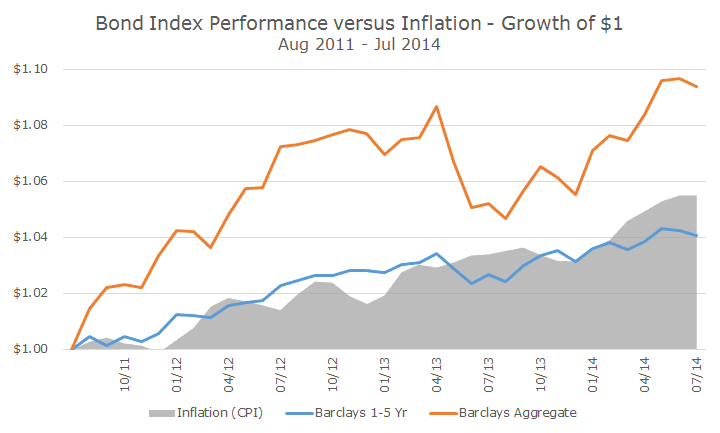

That means that the Barclays Aggregate Bond index is now up around 4.4 percent for the year, which implies an annualized rate of return of more than seven percent. Of course, we don’t know where rates will go from here and that annualized rate might not be achieved, but I mention it to demonstrate just how strong returns are at this point.

Last fall, I visited iShares headquarters in San Francisco and met a variety of executives from all over the firm. At one point, the new products manager came in and describe all of the short-term bond products that they were launching that would allow investors to take less interest rate in anticipation of higher rates.

Later, one of their chief bond strategists came in and we talked about how we were positioned and what the implications of the strategy might be. At that point, our duration, what is essentially the term of our bond portfolio was slightly less than the overall bond market as measured by the Barclays Aggregate.

I shared with him that we had been shorter a few years ago, but had extended our duration because we realized that we couldn’t time interest rate changes, just like we can’t time the overall stock market.

It was a nerve-wracking decision because rates have been so low for so long that it always felt like we were on the precipice of higher rates, which would hurt the longer duration portfolio.

I told him that I felt good about our approach but listening to the new product guy was a little discomforting. Although not in these words, the strategist basically said that they were just meeting demand and he thought we were doing the right thing, which was comforting.

So far, it appears like we made the right call. That can change of course, but here’s the salient point: as long as your time horizon is longer than the duration, you want rates to rise so that you can earn higher interest rates even though you will lose some money initially.

It turns out there was a fair amount of risk in holding the shorter-duration portfolio as well. Not market risk, but purchasing power risk. It’s like the person who keeps all of their money in cash because they don’t want to buys stocks just before a crash. Over the short term, there’s some comfort, but over the long-run, the purchasing power is eroded.

The following chart really sums up the issue and we only have to look back three years to see it plainly.

Successful investing, in stocks or bonds, requires many things, including:

- A certain amount of courage.

- A contrarian approach.

- Risk-taking.

- Remembering your time horizon.

- Discipline.

Sometimes it’s simple, but it’s never easy.