Interest rates are low and many investors are worried about rising rates, which can hurt bond prices. As always, Wall Street has rushed to the aid of investors by creating products to meet this need, just as they did with internet funds in the late 1990s and real estate funds during the bubble.

One of the ‘solutions’ that Wall Street has created to meet investor demand is something called a bank loan fund. They’re not new, actually, but the Wall Street product machine has been churning them out in new flavors and formats to accommodate the demand.

Instead of buying bonds, which are essentially securitized loans made to governments, municipalities or corporations, bank loan funds invest in floating-rate bank loans taken on by corporations. Because the loans are ‘floating-rate,’ there is really no term risk to speak of, so rising interest rates won’t have much of a negative impact, just like falling rates didn’t help out much in the past.

Even though there is no real term risk, the yields are still high; the SEC yield on the largest bank loan exchanged traded fund (ETF) is currently 4.32 percent. Compared to the overall bond market SEC yield of 2.13 percent, that’s pretty good and compared to a portfolio of floating-rate Treasury bonds that yield 0.08 percent, it’s fantastic!

No term risk and a lot of yield, who wouldn’t do that? Everybody knows that I love a free lunch (any lunch, actually), but unfortunately, bank loans are not a free lunch.

At the very least, I think that everyone knows that risk and return go hand in hand, so a high yield without one major risk factor usually means that there is another one standing in its place. In this case, there are two!

When these were launched a few years ago, we took a look at them and then dismissed them out of hand almost immediately because the credit quality is so bad. Remember, in bonds, there are two primary risk factors: term (the length of the loan) and credit (the risk of default). The principal bank loan fund on the market today is solidly junk.

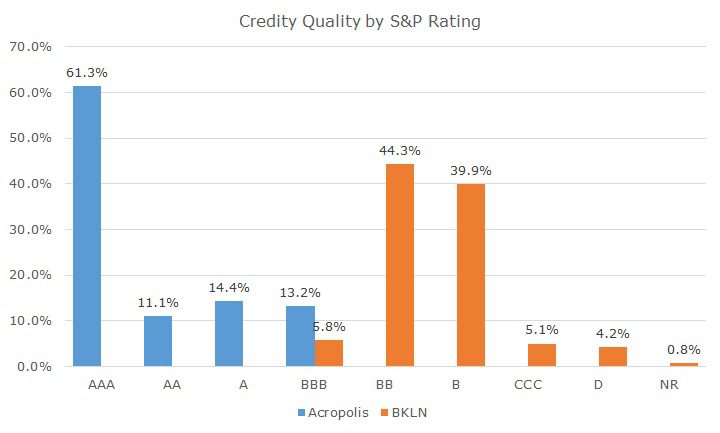

The chart shows that all but 5.8 percent of the fund is non-investment grade (also called ‘high yield’ in polite company and ‘junk’ among sailors), as indicated in orange. About five percent of the fund is actually in default (D) or not rated (NR), which is usually a bad sign.

For comparison sake, I also show what a typical Acropolis portfolio looks like in credit quality – mostly AAA, thanks to our government exposure, and no junk whatsoever.

You might ask, ‘shouldn’t we diversify across the credit spectrum?’ That’s a good question, but we don’t think so because it may diversify the bond exposure, but would actually reduce the diversification effects of the whole portfolio because junk bonds (and bank loans) are highly correlated with stocks.

Since the underlying index for the bank loan fund was created in 2001, the correlation to stocks is about 0.55. If that number isn’t useful – think about it this way: in 2008, the index of bank loans fell -28.18 percent. They lost badly just when you wanted the safety of bonds.

Aside from the credit quality (or lack thereof), there’s another problem with bank loans: they are inherently illiquid. Bonds are already less liquid than stocks because they trade on what’s called a negotiated market, which means guys and gals on the phone talking to each other. There is some computerization, but there is no exchange like the stock market.

Bond are less liquid than stocks, but bank loans are WAY less liquid than bonds. You can think of the settlement process operating a little bit like the Pony Express. OK, it’s not that bad, but it’s bad enough that just a little bit of asset flow out of the strategy can have very bad effects that are just starting to show up.

Of course, I don’t have a prediction for what will happen with bank loans from here, but I am so relieved knowing that clients don’t have them because when you want to sell and can’t get the market price, it’s very upsetting for everyone.

The whole situation is a good reminder of the truism: if something looks too good to be true, it probably is.