The stock market is suffering a setback, mostly due to the change in tone from the Federal Reserve.

That isn’t the whole story, in my opinion, however, because I don’t think it fully explains why the worst returns have been in the hottest part of the market, as I outlined last week.

Although I don’t have any particular evidence, I think that the selloff is related to deleveraging by hyper-aggressive investors. I don’t think it’s a coincidence that bitcoin is down -25 percent so far this year (and almost 50 percent since the peak in November).

I’m not familiar with the cryptocurrency market, but I’ve read that it is easy to leverage, well beyond what’s allowed in stocks.

But blaming the selloff entirely on cryptocurrencies isn’t right either. My story is simpler: that stocks are taking a breather after an incredible run over the past three years, where we saw the S&P 500 double.

I don’t want to minimize the loss this year, but taken in the context of the last three years (let alone the last decade) does make it a little easier to take in. And, it’s not like the market was cheap – valuations were, and remain, high.

And while we widen our gaze to include a longer time horizon, I think it’s also worth noting that the worst pain has been reserved for the investors taking the biggest bets.

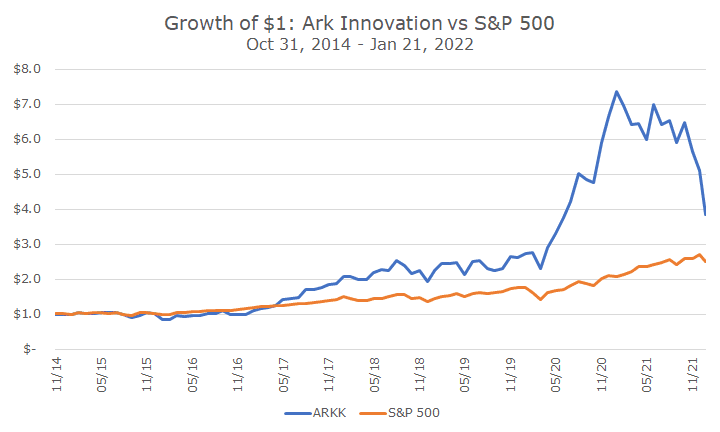

Back in May, I wrote about the ARK Innovation fund, an ETF run by Cathy Wood. The fund enjoyed absolutely spectacular returns in the last few years, as you can see from the chart below, which shows that a $1 invested in the ETF at the outset turned into seven dollars in six years.

I suspect that your eye was also drawn to the spectacular losses in recent months. That seven dollars are now worth four dollars. And, with the ARK ETF in the picture, you can barely see the recent losses on the S&P 500 because the scale is so crazy.

Of course, the fund still quadrupled for the early investors. That said, most investors weren’t early – the Wall Street Journal reported recently that the dollar-weighted returns show that investors have lost about a third of their money in the fund.

That’s because almost all of the money came in during 2020 and 2021, after the spectacular gains. Now investors are sitting on losses and are rushing for the exits.

I don’t have any ill will towards Cathy Wood or the fine people at ARK. When I wrote about it in May, I said that we wouldn’t invest in this kind of fund because it was too risky and the valuations were too high. At this moment, that looks like a good call, but in five years from now, who knows?

We’re still not going to invest in the fund, but if you want to take a small flier on it, that’s fine with me.

The point that I’m making today that I should have made in May is that narrow bets on anything, whether it’s innovation, genomics, nanobots, 3D printing, and the like should be small.

Indeed, we favor broadly diversified portfolios that include exposure outside the US, across different company sizes, sectors, style factors like value and momentum, and by individual securities.

It isn’t fun to miss the hot stocks when they are hot, but we find that it’s much harder to own them when they go cold, as they so often do.

Balanced may be boring, but we think investors can stick with it, and the optimal portfolio is the one that you can live with through all of the ups and downs.