Even though I was on vacation, I couldn’t resist checking market results right before bed (and sometimes during the day). I was shocked by two benchmark yields: the German 10-year below zero and the US 10-year at 1.57 percent.

German 10-year yields have never been negative and the US 10-year has was just 0.18 percent off its all-time low of 1.39 percent, set back in July 2012. At one point, intra-day, we were just 0.14 percent away from the bottom, but in either case, it’s just a stone’s throw away.

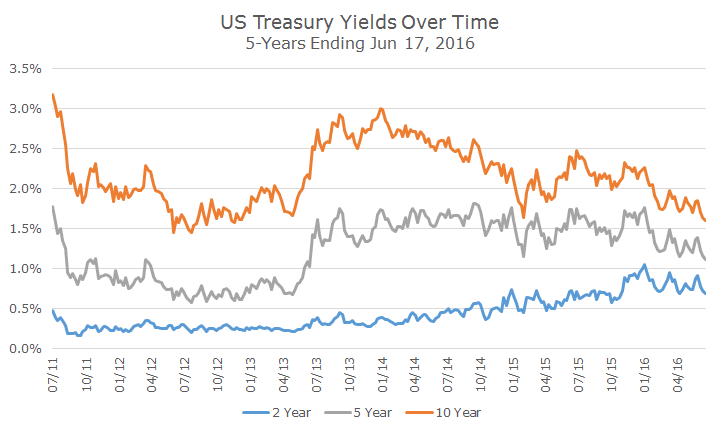

The chart below shows the yields for three US benchmarks for the last five years: the two-year (in blue), the five year (in gray) and 10-year (in orange).

You can see that before the so-called ‘taper tantrum’ in 2013, when yields shot up after former Fed Chair Bernanke made comments about tapering off the quantitative easing program, yields were fairly flat.

Since the taper tantrum, the story gets a little more interesting, in my opinion. Notice how the short end of the curve, the two year, drifts higher, while the longer-term yield, the 10-year, drifts steadily lower. The five year, which approximates where we are on the curve for most clients, is mostly flat until this year.

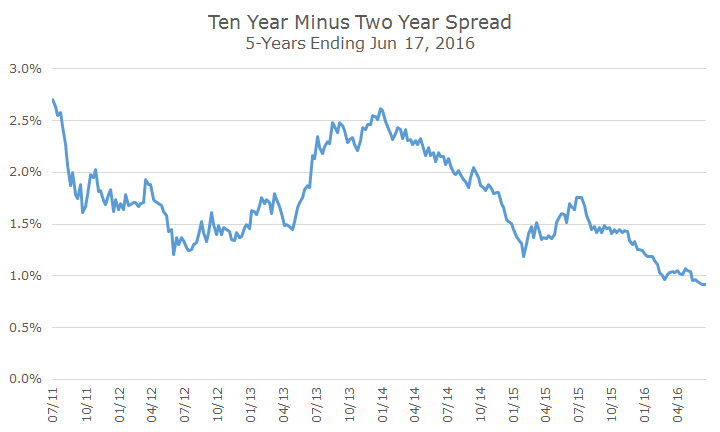

The process of shorter-term yields rising and longer-term yields falling means that the curve is flattening. The difference between short and long-term rates is less now than it was in mid-2013, which we can see in the chart below, which isolates this relationship by showing the difference, or spread, between the two and 10 year yields.

After the taper tantrum in 2013, the spread between short and long-term bonds fell steadily from 2.5 percent to less than one percent in recent weeks.

For the past several years, we’ve positioned our bond portfolio along the five-year area of the curve and cut our exposure to the longest part of the curve.

While we’ve missed out on the dropping rates, we’ve fared much better than had we continued with our short-duration strategy for two reasons: we’ve enjoyed the higher carry (or interest) associated with higher yields and we’ve benefited from falling rates.

We can see in the first chart above that the five-year hasn’t enjoyed as large a decline in rates as the 10-year, but we didn’t face the headwinds associated with higher rates at the short-end either.

If rate had gone the other way, we not be as happy, but it’s always nice to pause and enjoy the moment when things go your way.