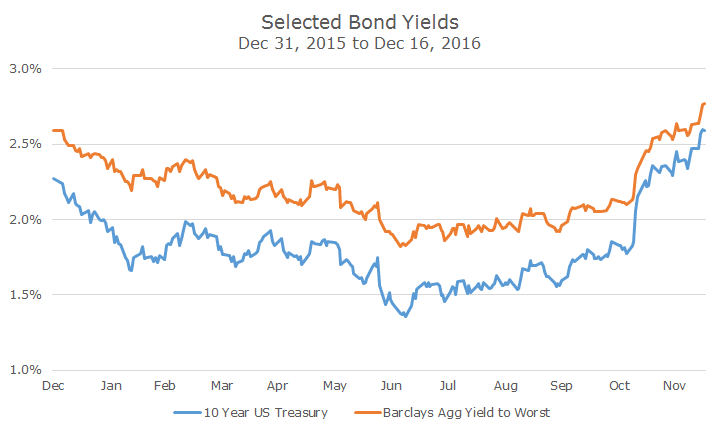

Since the election, interest rates have risen across the curve. The Federal Reserve raised short term interest rates last week for the first time this year, but perhaps more importantly, longer term rates have also risen, which means falling bond prices.

Right now, the Barclays Aggregate Bond index is still positive for the year, but the gains are muted, especially compared to the 5.8 percent gain that they enjoyed just six weeks ago (click here for more details).

I thought it would be interesting to interview Ryan Craft, our chief bond analyst, to see what’s happening and how it might affect our portfolio.

How surprised are you by the move up in interest rates – not the move by the Fed, which was widely telegraphed, but in the longer end of the curve?

RC: I was somewhat surprised by the quickness and magnitude of the change, but not necessarily by the move itself. I also don’t think that the shift in rates is entirely explained by the election. The other factors include a reversal of the ‘fear trade,’ which has been going on for years where investors flock to safer assets such as US Treasury bonds to avoid uncertainty. This, along with central bank policies, took yields around the world into negative territory and it came to a paramount this summer with the uncertainty surrounding the Brexit vote.

Over the summer, you can see that everything was locked up and that there was a lot of sideways movement. Once the election hit, yields just broke free. And, of course, the Fed reducing monetary stimulus is a part of it too.

Recognizing that no one knows the answer to this, how high do you think rates could go from here?

In the short-term, you could see spikes, but I’m not sure that the economy can take substantially higher interest rates. There’s research now that shows that if the yield on the 10-year Treasury gets up to 2.65 or 2.75 percent that it would negatively affect the economy.

I wrote an article for ALM Insights about the debt level in our country (that you can read by clicking here: the article starts on page six). The last time the Fed was raising short-term interest rates in 2004, the total-debt-to-GDP was 180 percent.

When you look at public and private balance sheets today, we’re almost at 260 percent, meaning that our total debt, both public and private, are much higher relative to the size of our economy. Small changes in interest rates will be magnified today because the economy is more tied to borrowing costs. It’s like anything with leverage.

We’re already seeing mortgage activity slowing down, but we’ll see more later because it always takes time for changes in rates to filter through the economy.

Are we going to make changes to our bond portfolio? If we think that rates are going to go higher, why wouldn’t we shorten the duration of our portfolio?

I could make just as good an argument for rates falling from here as I could for rates going higher. Also, the yield curve is steep right now. The most attractive part of the curve from a risk/return and carry (yield) standpoint is six or seven years. There’s a huge opportunity cost to shortening the portfolio in the form of lost income while waiting for rates to rise.

What if rates don’t go any higher from here? The Fed’s forecast for next that just came out last week calls for three hikes to the overnight rate. They’re the most aggressive forecaster in the market right now – the market only thinks that there is one or two more coming.

The Fed has consistently had much greater expectations than the market. This time last year, they projected four increases and we got one. The year before that, they said four and we got zero. Their track record is not very good.

Forecasting changes in interest rates is an impossible task. This is why we plan on sticking with our strategy that looks to invest where relative value among rates is most attractive, not to gamble on the direction that rates will move next.

I like Gary Melchior’s old argument that moving bond duration around is akin to trying to time the stock market since duration is essentially the main beta for bonds.

Exactly. The market rate incorporates the views of all investors and is essentially the fairest rate. We accept that.

Thanks, Ryan.

Anytime.