Last week, I wrote about how losses at the Swiss mining company Glencore were affecting the overall market. In the article (found here), I said that bond prices in the market often reflect credit conditions before the ratings agencies like S&P and Moody’s make any changes.

The Glencore situation may be a good example because bond prices have changed markedly in recent weeks as investors worry about their credit worthiness. It may prove not to be a good example, though, if Glencore can make changes to their balance sheet quickly and their bond prices recover before any action is necessary. Markets are unpredictable that way.

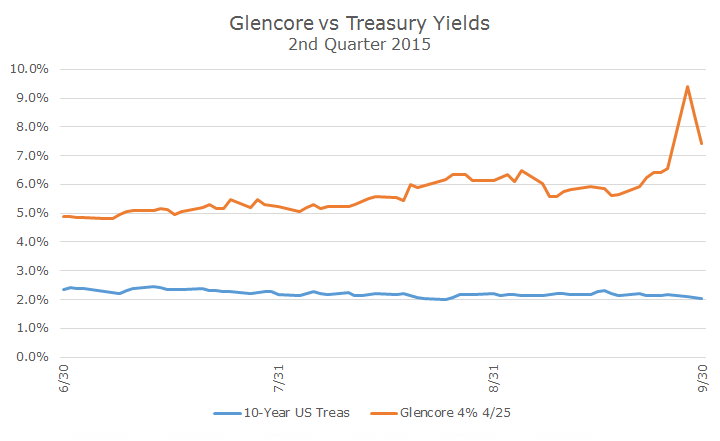

First, let’s look at what happened last quarter with a 10-year bond issued by Glencore. At the outset of the quarter, it was yielding five percent, which makes sense because it’s has a BBB rating.

Over the quarter, you can see the yield drifting higher (which means that the price is drifting lower) and crosses six percent in August. Then, when I wrote my article, the yield spikes to over nine percent but settles down some after that.

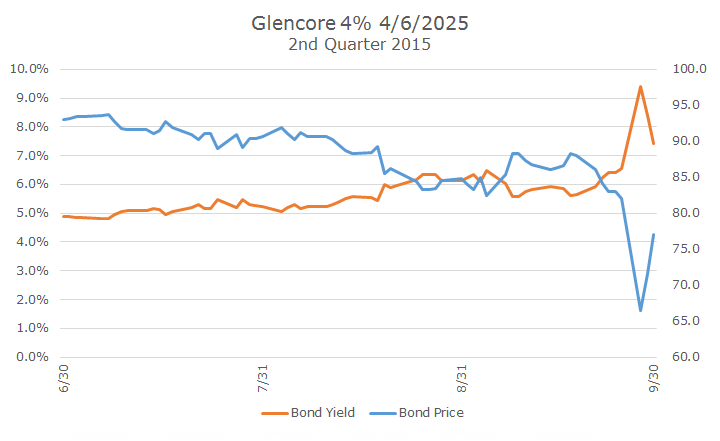

Since a lot of people don’t find the higher yield/lower price construction very intuitive, I thought a chart would be helpful. The yield is the same as the previous chart, but now I’ve got the price on the secondary axis and you can see it’s basically a mirror image of the yield.

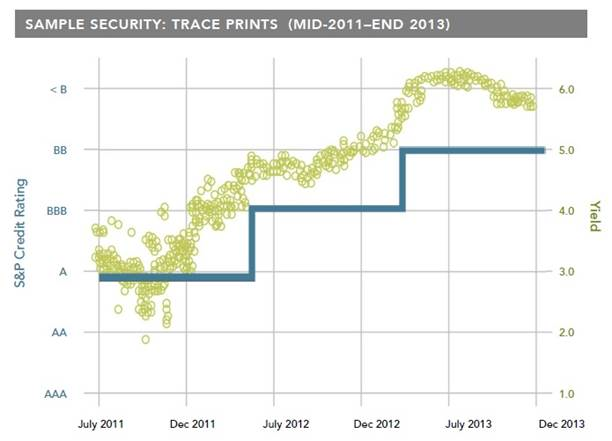

Now let’s look at an example put together by Dimensional Fund Advisors (DFA) that illustrates the point. In this example, they track a bond that was A rated in July 2011.

The yield, as illustrated by the little green circles, starts rising by the end of 2011, but the credit rating doesn’t change until the middle of 2012 (as seen with the solid blue line). The yields keep rising over time and S&P ultimately cuts the rating again.

What should be perfectly obvious from this chart is that the prices are running ahead of the ratings agencies, which makes sense because all of the independent investors are doing their own credit analysis and trading on that information without waiting for S&P.

Some investors might look at the prices (or yields) and think that they’ve found a ‘deal’ compared to other bonds with the same rating. They may end up being right, but more often than not, we think that the ratings will catch up with the prices.

We principally use DFA to get our corporate bond exposure and it’s quite possible that they had Glencore bonds in one of their global credit portfolios because it is investment grade. However, DFA sells bonds that aren’t trading like their credit rating. If the yield on a bond that is officially BBB starts trading with a yield that looks more like a non-investment grade CCC bond, then they will sell it.

This is a great example of the power of markets and how they can quickly and efficiently respond to new information. Market prices contain a good deal of information that can be useful for investors like us.