To my surprise, it’s been more than three years since I wrote about negative yields on bonds throughout the world. In my article, which can be found here, I wrote that bond yields could go a lot lower than I ever thought since I thought that they were ‘zero-bound.’

A year later, I returned to the topic when the yield on 50-year Swiss bonds had a negative yield. The article is here, but think about that: 50 years! Then, I wrote that negative yields were hanging around a lot longer than I thought they could, but that was in 2016.

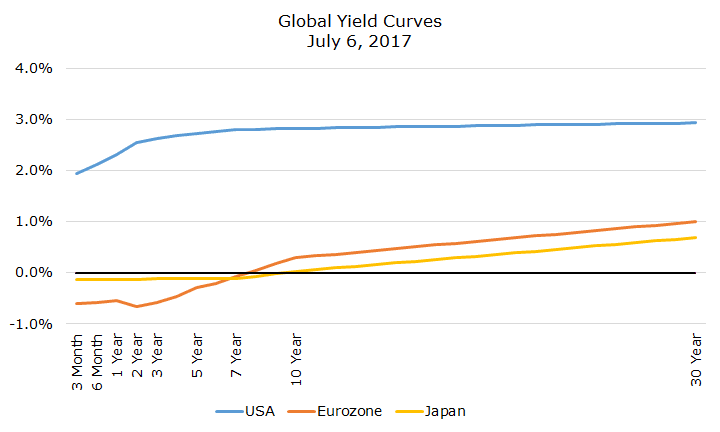

Now, here I am, in the middle of 2018 with a picture of the yield curve that shows negative rates all the way out to seven years in two of the three major world markets, Japan and the eurozone.

My earlier articles can be summarized as follows: 1. Wow, I can’t believe yields are negative! 2. Yikes, I can’t believe yields can be THIS negative! 3. Geez, I can’t believe negative yields lasted more than a few months. Now, my message is: Holy moly, I never thought they could stay negative for years!

Why are negative rates so shocking? Because they really blow up the basic investing calculus. If the basic idea of investing is balancing risk and reward, how do negative interests rates make sense? Why would I buy a five-year government bonds if I won’t even get my money back? Why should I pay the government to hold my money?

Negative rates make people do weird things. Recently, I read that people in Sweden drastically overpaid their taxes. Why? Because the Swedish government pays 0.60 percent interest on excess payments. Even though there isn’t a lot of time between the excess payment and the refund, it sure beat losing money with your deposit at the bank.

The European Central Bank (ECB) said that they would keep their overnight rates negative ‘at least through the summer of 2019,’ and Japan is likely to go on much longer than that.

I hope that my next article isn’t ‘Wowzers, how will central banks respond to a recession since rates are already negative?’ I hope that rates will turn positive in the not too distant future because negative rates are a signal of a sick (albeit improving) economy and I want the world to be better off economically.